Question: 3. (18 points) [You are allowed to answer this question within two pages] A fund manager constructs two funds which are made of four stocks

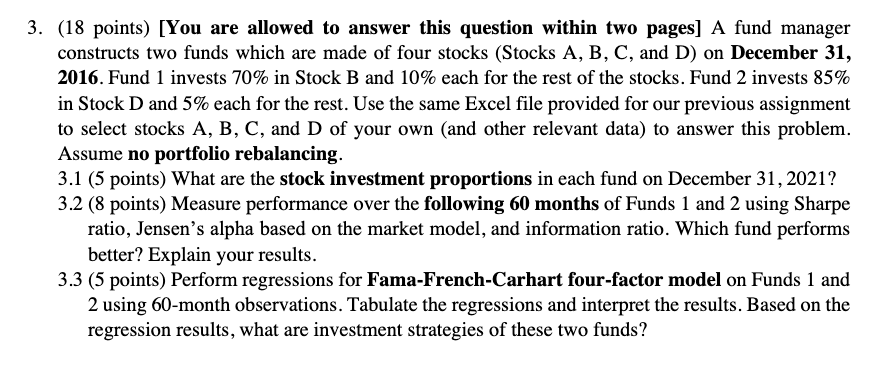

3. (18 points) [You are allowed to answer this question within two pages] A fund manager constructs two funds which are made of four stocks (Stocks A, B, C, and D) on December 31, 2016. Fund 1 invests 70% in Stock B and 10% each for the rest of the stocks. Fund 2 invests 85% in Stock D and 5% each for the rest. Use the same Excel le provided for our previous assignment to select stocks A, B, C, and D of your own (and other relevant data) to answer this problem. Assume no portfolio rebalancing. 3.1 (5 points) What are the stock investment proportions in each fund on December 31, 2021 'P 3.2 (8 points) Measure performance over the following 60 months of Funds 1 and 2 using Sharpe ratio, Jensen's alpha based on the market model, and information ratio. Which fund performs better? Explain your results. 3 .3 (5 points) Perform regressions for Fama-French-Carhart four-factor model on Funds 1 and 2 using 60-month observations. Tahulate the regressions and interpret the results. Based on the regression results, what are investment strategies of these two funds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts