Question: 3) (20 points) Consider the stock return scenarios for five stocks shown in the following table. Develop a Markowitz portfolio model for these data with

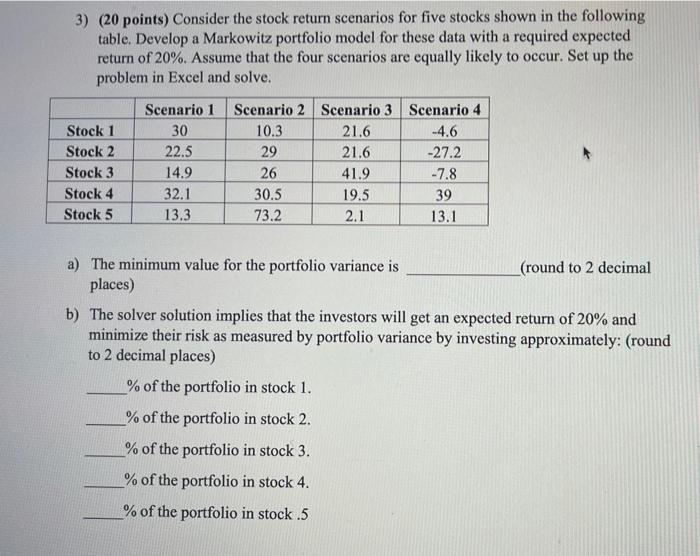

3) (20 points) Consider the stock return scenarios for five stocks shown in the following table. Develop a Markowitz portfolio model for these data with a required expected return of 20%. Assume that the four scenarios are equally likely to occur. Set up the problem in Excel and solve. Stock 1 Stock 2 Stock 3 Stock 4 Stock 5 Scenario 1 30 22.5 14.9 32.1 13.3 Scenario 2 Scenario 3 Scenario 4 10.3 21.6 -4.6 29 21.6 -27.2 41.9 -7.8 30.5 19.5 39 73.2 2.1 13.1 26 a) The minimum value for the portfolio variance is (round to 2 decimal places) b) The solver solution implies that the investors will get an expected return of 20% and minimize their risk as measured by portfolio variance by investing approximately: (round to 2 decimal places) % of the portfolio in stock 1. % of the portfolio in stock 2. % of the portfolio in stock 3. % of the portfolio in stock 4. % of the portfolio in stock .5 3) (20 points) Consider the stock return scenarios for five stocks shown in the following table. Develop a Markowitz portfolio model for these data with a required expected return of 20%. Assume that the four scenarios are equally likely to occur. Set up the problem in Excel and solve. Stock 1 Stock 2 Stock 3 Stock 4 Stock 5 Scenario 1 30 22.5 14.9 32.1 13.3 Scenario 2 Scenario 3 Scenario 4 10.3 21.6 -4.6 29 21.6 -27.2 41.9 -7.8 30.5 19.5 39 73.2 2.1 13.1 26 a) The minimum value for the portfolio variance is (round to 2 decimal places) b) The solver solution implies that the investors will get an expected return of 20% and minimize their risk as measured by portfolio variance by investing approximately: (round to 2 decimal places) % of the portfolio in stock 1. % of the portfolio in stock 2. % of the portfolio in stock 3. % of the portfolio in stock 4. % of the portfolio in stock .5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts