Question: (3) (25 points) Here, we will implement the binomial model for asset prices as well as the binomial method for pricing (portfolios of) options

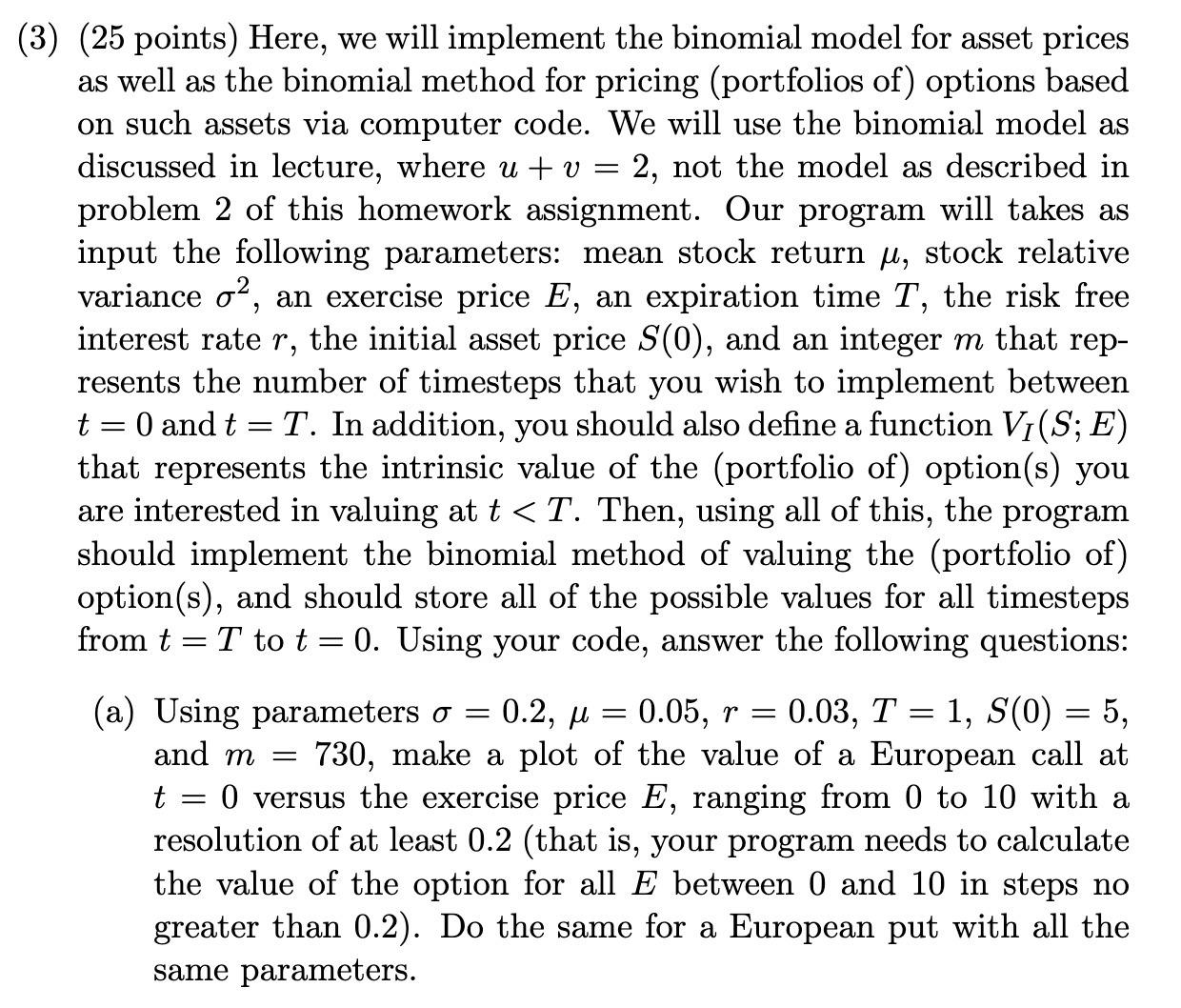

(3) (25 points) Here, we will implement the binomial model for asset prices as well as the binomial method for pricing (portfolios of) options based on such assets via computer code. We will use the binomial model as discussed in lecture, where u + v = = 2, not the model as described in problem 2 of this homework assignment. Our program will takes as input the following parameters: mean stock return , stock relative variance , an exercise price E, an expiration time T, the risk free interest rate r, the initial asset price S(0), and an integer m that rep- resents the number of timesteps that you wish to implement between t = 0 and t = T. In addition, you should also define a function VI (S; E) that represents the intrinsic value of the (portfolio of) option(s) you are interested in valuing at t < T. Then, using all of this, the program should implement the binomial method of valuing the (portfolio of) option(s), and should store all of the possible values for all timesteps from t = T to t = 0. Using your code, answer the following questions: (a) Using parameters = 0.2, = 0.05, r = 0.03, T = 1, S(0) = 5, 730, make a plot of the value of a European call at t = 0 versus the exercise price E, ranging from 0 to 10 with a resolution of at least 0.2 (that is, your program needs to calculate the value of the option for all E between 0 and 10 in steps no greater than 0.2). Do the same for a European put with all the same parameters. and m =

Step by Step Solution

3.64 Rating (162 Votes )

There are 3 Steps involved in it

To implement the binomial method for valuing European call and put options and create a plot of thei... View full answer

Get step-by-step solutions from verified subject matter experts