Question: 3. (25 Pts) Consider a 10-year project which will be undertaken through project financing. Only long- term debt and common equity will be utilized as

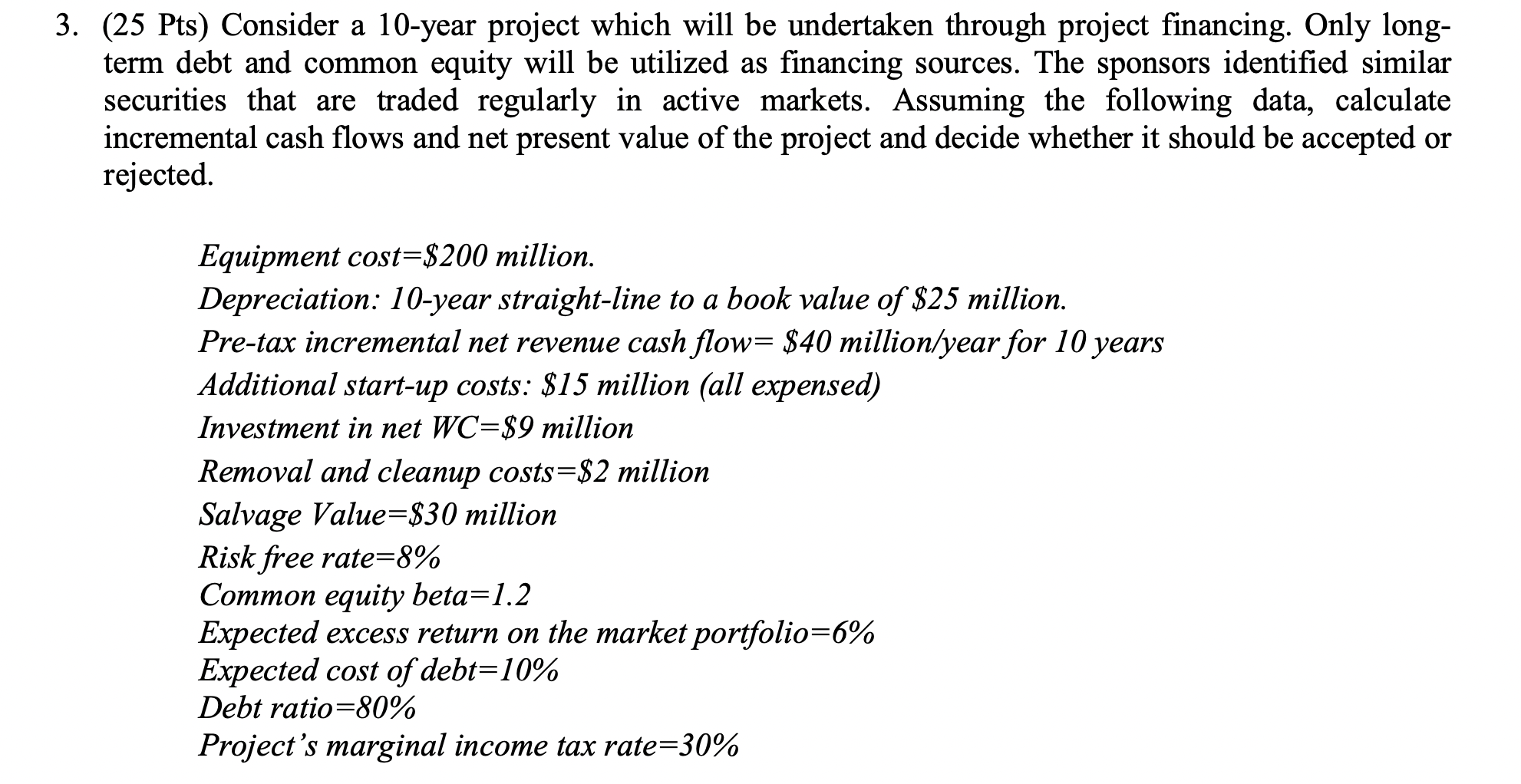

3. (25 Pts) Consider a 10-year project which will be undertaken through project financing. Only long- term debt and common equity will be utilized as financing sources. The sponsors identified similar securities that are traded regularly in active markets. Assuming the following data, calculate incremental cash flows and net present value of the project and decide whether it should be accepted or rejected. Equipment cost=$200 million. Depreciation: 10-year straight-line to a book value of $25 million. Pre-tax incremental net revenue cash flow= $40 million/year for 10 years Additional start-up costs: $15 million (all expensed) Investment in net WC=$9 million Removal and cleanup costs=$2 million Salvage Value=$30 million Risk free rate=8% Common equity beta=1.2 Expected excess return on the market portfolio=6% Expected cost of debt=10% Debt ratio=80% Project's marginal income tax rate=30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts