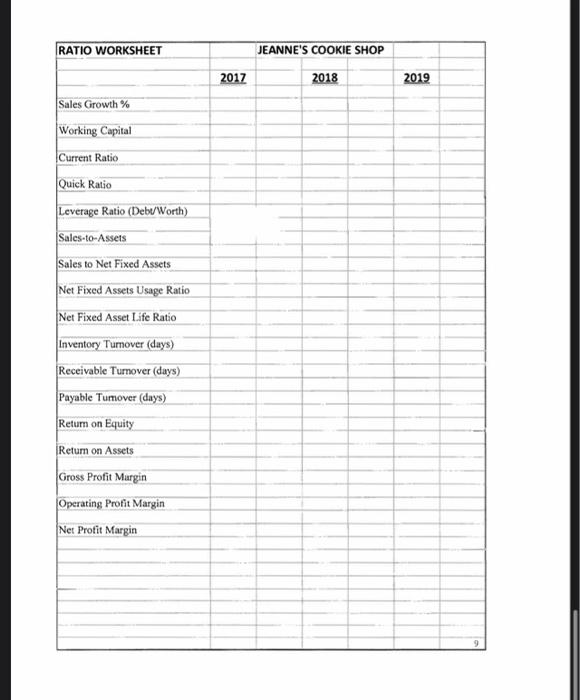

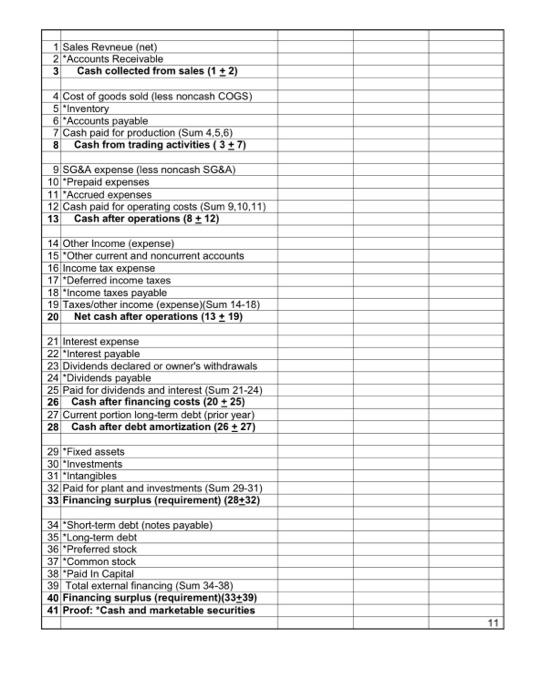

Question: for this assignment please read the background, and answer the following questions on pages 4-5. Also please complete and show work on the ratio worksheet

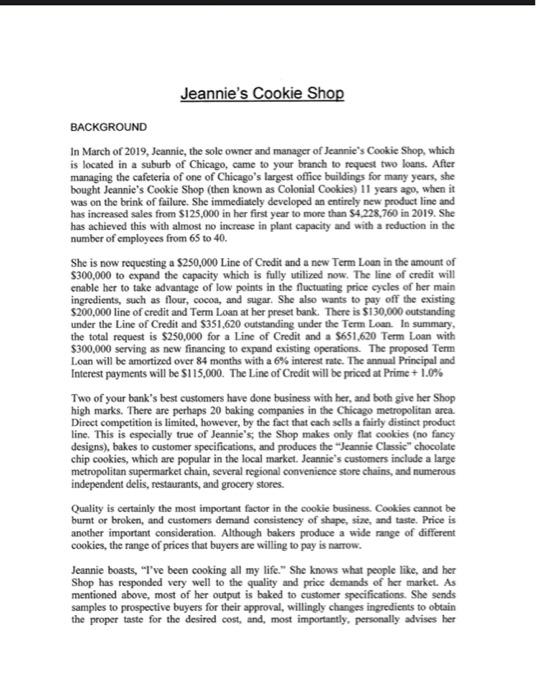

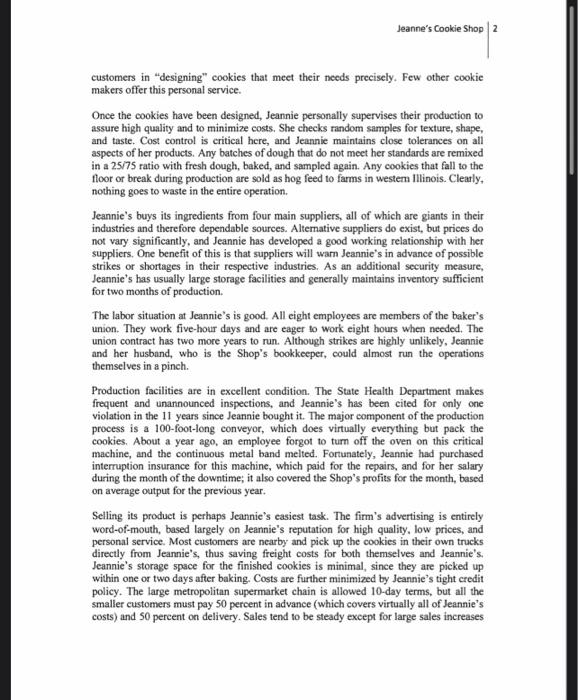

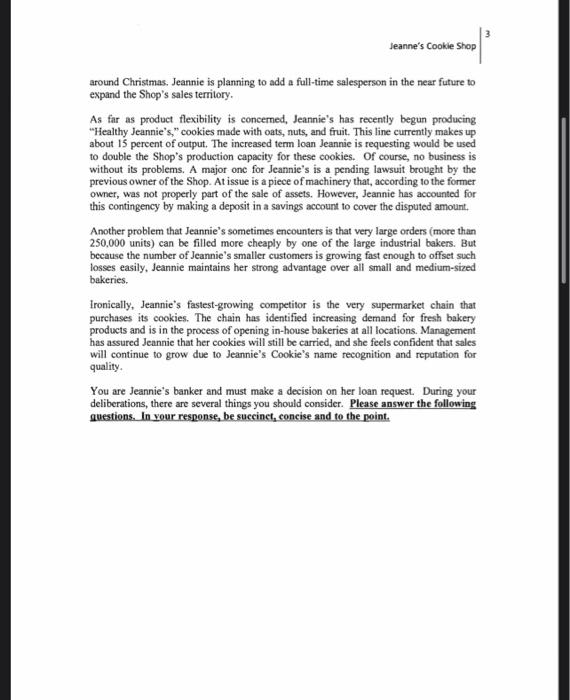

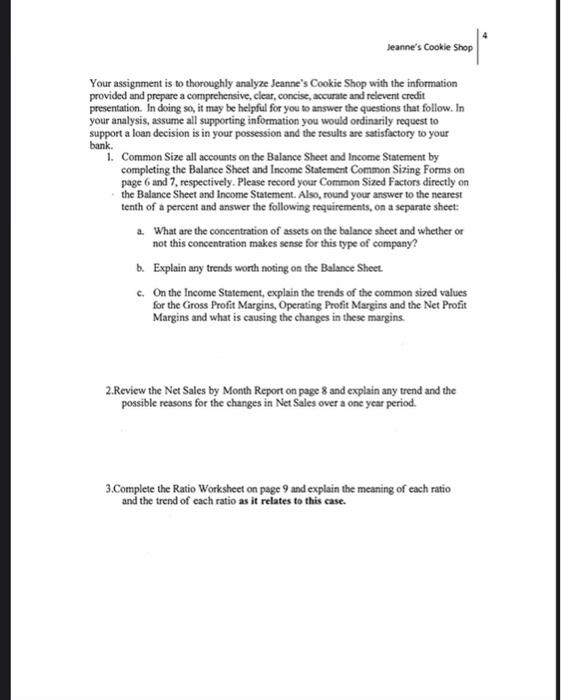

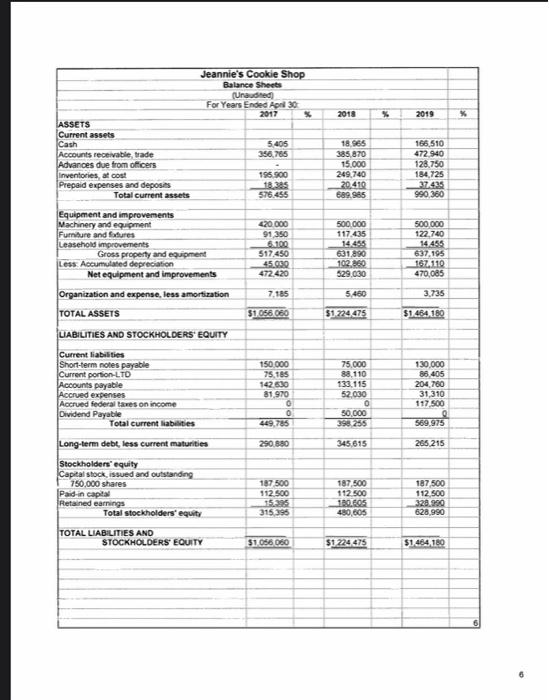

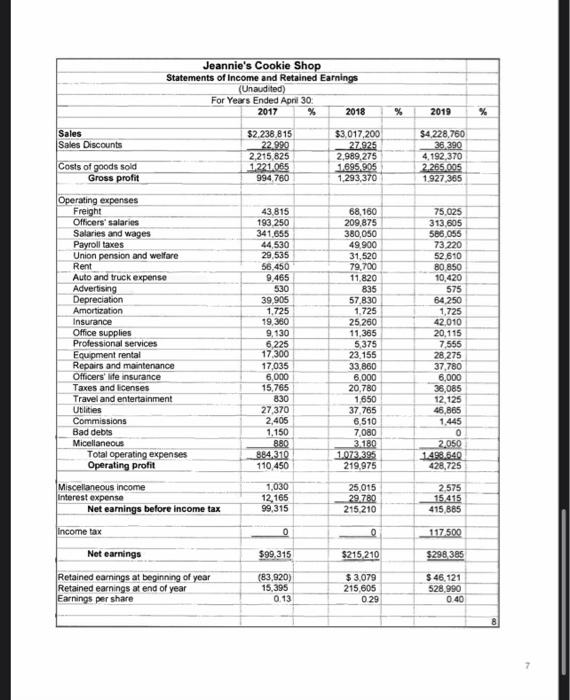

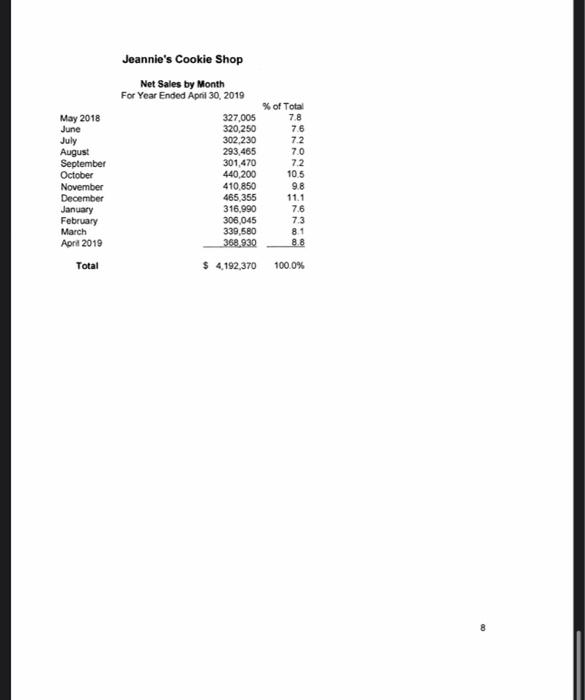

Jeannie's Cookie Shop BACKGROUND In March of 2019, Jeannic, the sole owner and manager of Jeannie's Cookie Shop, which is located in a suburb of Chicago, came to your branch to request two loans. After managing the cafeteria of one of Chicago's largest office buildings for many years, she bought Jeannie's Cookie Shop (then known as Colonial Cookies) 11 years ago, when it was on the brink of failure. She immediately developed an entirely new product line and has increased sales from $125,000 in her first year to more than 54.228.160 in 2019. She has achieved this with almost no increase in plant capacity and with a reduction in the number of employees from 65 to 40. She is now requesting a $250,000 Line of Credit and a new Term Loan in the amount of $300,000 to expand the capacity which is fully utilized now. The line of credit will enable her to take advantage of low points in the fluctuating price cycles of her main ingredients, such as flour, cocon, and sugar. She also wants to pay off the existing $200,000 line of credit and Term Loan at her preset bank. There is $130,000 outstanding under the Line of Credit and $351,620 outstanding under the Term Loan. In summary, the total request is $250,000 for a Line of Credit and a $651,620 Term Loan with $300,000 serving as new financing to expand existing operations. The proposed Term Loan will be amortized over 84 months with a 6% interest rate. The annual Principal and Interest payments will be $115,000. The Line of Credit will be priced at Prime + 1.0% Two of your bank's best customers have done business with her, and both give her Shop high marks. There are perhaps 20 baking companies in the Chicago metropolitan area Direct competition is limited, however, by the fact that cach sells a fairly distinct product line. This is especially true of Jeannie's, the Shop makes only flat cookies (no fancy designs), bakes to customer specifications, and produces the "Jeannie Classic" chocolate chip cookies, which are popular in the local market. Jcannie's customers include a large metropolitan supermarket chain, several regional convenience store chains, and numerous independent delis, restaurants, and grocery stores. Quality is certainly the most important factor in the cookie business. Cookies cannot be burnt or broken, and customers demand consistency of shape, size, and taste. Price is another important consideration. Although bakers produce a wide range of different cookies, the range of prices that buyers are willing to pay is narrow. Jeannie boasts, "I've been cooking all my life." She knows what people like, and her Shop has responded very well to the quality and price demands of her market. As mentioned above, most of her output is baked to customer specifications She sends samples to prospective buyers for their approval , willingly changes ingredients to obtain the proper taste for the desired cost, and, most importantly, personally advises her Jeanne's Cookie Shop 2 a customers in designing" cookies that meet their needs precisely. Few other cookie makers offer this personal service. Once the cookies have been designed, Jeannie personally supervises their production to assure high quality and to minimize costs. She checks random samples for texture, shape, and taste. Cost control is critical here, and Jeannie maintains close tolerances on all aspects of her products. Any batches of dough that do not meet her standards are remixed in a 25/75 ratio with fresh dough, baked, and sampled again. Any cookies that fall to the floor or break during production are sold as hog feed to farms in western Illinois. Clearly, nothing goes to waste in the entire operation. Jeannie's buys its ingredients from four main suppliers, all of which are giants in their industries and therefore dependable sources. Alternative suppliers do exist, but prices do not vary significantly, and Jeannie has developed a good working relationship with her suppliers. One benefit of this is that suppliers will wam Jeannie's in advance of possible strikes or shortages in their respective industries. As an additional security measure, Jeannie's has usually large storage facilities and generally maintains inventory sufficient for two months of production The labor situation at Jeannie's is good. All eight employees are members of the baker's union. They work five-hour days and are eager to work eight hours when needed. The union contract has two more years to run. Although strikes are highly unlikely, Jeannie and her husband, who is the Shop's bookkeeper, could almost run the operations themselves in a pinch. Production facilities are in excellent condition. The State Health Department makes frequent and unannounced inspections, and Jeannie's has been cited for only one violation in the 11 years since Jeannie bought it. The major component of the production process is a 100-foot-long conveyor, which does virtually everything but pack the cookies. About a year ago, an employee forgot to turn off the oven on this critical machine, and the continuous metal band melted. Fortunately, Jeannie had purchased interruption insurance for this machine, which paid for the repairs, and for her salary during the month of the downtime; it also covered the Shop's profits for the month, based on average output for the previous year. Selling its product is perhaps Jeannie's easiest task. The firm's advertising is entirely word-of-mouth, based largely on Jeannie's reputation for high quality, low prices, and personal service. Most customers are nearby and pick up the cookies in their own trucks directly from Jeannie's, thus saving freight costs for both themselves and Jeannie's. Jeannie's storage space for the finished cookies is minimal, since they are picked up within one or two days after baking. Costs are further minimized by Jeannie's tight credit policy. The large metropolitan supermarket chain is allowed 10-day terms, but all the smaller customers must pay 50 percent in advance (which covers virtually all of Jeannie's costs) and 50 percent on delivery. Sales tend to be steady except for large sales increases 3 Jeanne's Cookie Shop around Christmas. Jeannie is planning to add a full-time salesperson in the near future to expand the Shop's sales territory As far as product flexibility is concerned, Jeannie's has recently begun producing "Healthy Jeannie's," cookies made with oats, nuts, and fruit. This line currently makes up about 15 percent of output. The increased term loan Jeannie is requesting would be used to double the Shop's production capacity for these cookies. Of course, no business is without its problems. A major one for Jeannie's is a pending lawsuit brought by the previous owner of the Shop. At issue is a piece of machinery that, according to the former owner, was not properly part of the sale of assets. However, Jeannic has accounted for this contingency by making a deposit in a savings account to cover the disputed amount. Another problem that Jeannie's sometimes encounters is that very large orders (more than 250,000 units) can be filled more cheaply by one of the large industrial bakers. But because the number of Jeannie's smaller customers is growing fast enough to offset such losses easily, Jeannie maintains her strong advantage over all small and medium-sized bakeries. Ironically, Jeannie's fastest-growing competitor is the very supermarket chain that purchases its cookies. The chain has identified increasing demand for fresh bakery products and is in the process of opening in-house bakeries at all locations Management has assured Jeannie that her cookies will still be carried, and she feels confident that sales will continue to grow due to Jeannie's Cookie's name recognition and reputation for quality You are Jeannie's banker and must make a decision on her loan request. During your deliberations, there are several things you should consider. Please answer the following questions. In your response, be succinct, concise and to the point. Jeanne's Cookie Shop Your assignment is to thoroughly analyze Jeanne's Cookie Shop with the information provided and prepare a comprehensive, clear, concise, accurate and relevent credit presentation. In doing so, it may be helpful for you to answer the questions that follow. In your analysis, assume all supporting information you would ordinarily request to support a loan decision is in your possession and the results are satisfactory to your bank. 1. Common Size all accounts on the Balance Sheet and income Statement by completing the Balance Sheet and Income Statement Common Sizing Forms on page 6 and 7 respectively. Please record your Common Sized Factors directly on the Balance Sheet and income Statement. Also, round your answer to the nearest tenth of a percent and answer the following requirements, on a separate sheet: 2. What are the concentration of assets on the balance sheet and whether or not this concentration makes sense for this type of company? b. Explain any trends worth noting on the Balance Sheet c. On the Income Statement, explain the trends of the common sized values for the Gross Profit Margins. Operating Profit Margins and the Net Profit Margins and what is causing the changes in these margins. 2. Review the Net Sales by Month Report on page 8 and explain any trend and the possible reasons for the changes in Net Sales over a one year period. 3.Complete the Ratio Worksheet on page 9 and explain the meaning of each ratio and the trend of each ratio as it relates to this case. Jeanne's Cookie Shop 4. Complete the Uniform Cash Analysis for 2018 and 2019 on page 10. Please Explain: a. What are the primary sources and uses of Cash? b. Is there sufficient cash flow to service the annual Current Portion of Long Term Debt for 2019 and anticipated for 20202 c. What section of the Uniform Cash Analysis led you to your answer in 3(b)? Jeannie's Cookie Shop Balance Sheets (Uradne For Years Ended April 30 2017 2018 % 2019 X 5.405 356,765 ASSETS Current assets Cash Accounts receivable, trade Advances due from officers Inventories at cost Prepaid expenses and deposits Total current assets 18.965 385 870 15.000 249.740 20.419 689.985 166,510 472 940 128.750 184.725 37.435 990 360 196.900 18.385 576.455 420.000 91 350 6.100 517.450 45.000 472420 500.000 117.435 14.455 631.890 102.860 529,030 500 000 122.740 14 455 637,195 1674110 470,085 7.185 5.460 3.735 $1.056,060 $1 724 475 Equipment and improvements Machinery and equipment Furniture and Satures Leasehold improvements Gross property and equipment Less Accumulated depreciation Net equipment and improvements Organization and expense, less amortization TOTAL ASSETS UABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Short-term notes payable Current portion LTO Accounts payable Accrued expenses Accrued federal taxes on income Dividend Payable Total current liabilities $1.484 180 150.000 75.185 142 610 81.970 0 0 449,785 75 000 88,110 133 115 52.030 0 30.000 398 255 130,000 86.405 204 700 31,310 117.500 569.975 290 880 345 615 265,215 Long-term debt, less current maturities Stockholders' equity Capital stock, issued and outstanding 750,000 shares Paid in capite Retained earnings Total stockholders' equity 187.500 112.500 15:35 315 395 187.500 112.500 160 FOS 480,605 187 500 112.500 328.990 628,990 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 1056 060 $1 224 475 $1.464 180 Jeannie's Cookie Shop Statements of Income and Retained Earnings (Unaudited) For Years Ended Apni 30 2017 % 2018 % 2019 % Sales Sales Discounts $2.238 815 22 990 2,215,825 1221.065 994 760 $3,017,200 27.925 2,989,275 1695.905 1.293,370 $4 228,760 36 390 4.192.370 2.265.005 1.927,385 Costs of goods sold Gross profit 68,160 Operating expenses Freight Officers' salaries Salaries and wages Payroll taxes Union pension and welfare Rent Auto and truck expense Advertising Depreciation Amortization Insurance Office supplies Professional services Equipment rental Repairs and maintenance Officers' we insurance Taxes and licenses Travel and entertainment Ublities Commissions Bad debts Micellaneous Total operating expenses Operating profit 43.815 193 250 341,655 44,530 29,535 56.450 9.465 530 39.905 1,725 19.380 9,130 6225 17.300 17,035 6,000 15.765 830 27,370 2,405 1.150 880 884.310 110,450 209.875 380,050 49.900 31,520 79,700 11.820 835 57 830 1.725 25,260 11.365 5,375 23.155 33 860 6,000 20.780 1650 37.765 6,510 7,080 3.180 1073.395 219,975 75,025 313 605 586.055 73.220 52.610 80 850 10,420 575 84 250 1,725 42,010 20.115 7.555 28 275 37.780 6,000 36,085 12 125 46,865 1.445 0 2.050 1498.640 428,725 1.030 12,165 99,315 25.015 29.780 215.210 2.575 15 415 415,885 Miscellaneous income Interest expense Net earnings before income tax income tax Net earnings 0 0 117.500 $99 315 $215,210 $298,385 Retained earnings at beginning of year Retained earnings at end of year Earnings per share (83,920) 15,395 0.13 $ 3,079 215 605 0.29 $ 46,121 528,990 0.40 % of Total 7.8 7.6 May 2018 June July August September October November December January February March April 2019 Jeannie's Cookie Shop Net Sales by Month For Year Ended April 30, 2019 327,005 320,250 302,230 293,465 301,470 440,200 410 850 465,355 316.990 306,045 339 368.930 7.2 7.0 72 10.5 9.8 11.1 7.6 7.3 Total $ 4,192,370 100.0% 8 RATIO WORKSHEET JEANNE'S COOKIE SHOP 2017 2018 2019 Sales Growth % Working Capital Current Ratio Quick Ratio Leverage Ratio (Debt/Worth) Sales-to-Assets Sales to Net Fixed Assets Net Fixed Assets Usage Ratio Net Fixed Asset Life Ratio Inventory Tumover (days) Receivable Turnover (days) Payable Tumover (days) Return on Equity Retum on Assets Gross Profit Margin Operating Profit Margin Net Protit Margin 1 Sales Revneue (net) 2 Accounts Receivable 3 Cash collected from sales (1 : 2) 4 Cost of goods sold (less noncash COGS) 5 "inventory 6 Accounts payable 7 Cash paid for production (Sum 4,5,6) Cash from trading activities ( 3 +7) 9 SG&A expense (less noncash SG&A) 10 Prepaid expenses 11 Accrued expenses 12 Cash paid for operating costs (Sum 9,10,11) Cash after operations (8 +12) 8 13 14 Other Income (expense) 15 "Other current and noncurrent accounts 16 Income tax expense 17 Deferred income taxes 18 "Income taxes payable 19 Taxes/other income (expenseSum 14-18) 20 Net cash after operations (13 - 19) 21 Interest expense 22 "Interest payable 23 Dividends declared or owner's withdrawals 24 "Dividends payable 25 Paid for dividends and interest (Sum 21-24) 26 Cash after financing costs (20 + 25) 27 Current portion long-term debt (prior year) 28 Cash after debt amortization (26 + 27) 29 Fixed assets 30 "Investments 31 "Intangibles 32 Paid for plant and investments (Sum 29-31) 33 Financing surplus (requirement) (28+32) 34 "Short-term debt (notes payable) 35 "Long-term debt 36 Preferred stock 37 "Common stock 38 Paid In Capital 39 Total external financing (Sum 34-38) 40 Financing surplus (requirement)(33+39) 41 Proof: 'Cash and marketable securities 11 Jeannie's Cookie Shop BACKGROUND In March of 2019, Jeannic, the sole owner and manager of Jeannie's Cookie Shop, which is located in a suburb of Chicago, came to your branch to request two loans. After managing the cafeteria of one of Chicago's largest office buildings for many years, she bought Jeannie's Cookie Shop (then known as Colonial Cookies) 11 years ago, when it was on the brink of failure. She immediately developed an entirely new product line and has increased sales from $125,000 in her first year to more than 54.228.160 in 2019. She has achieved this with almost no increase in plant capacity and with a reduction in the number of employees from 65 to 40. She is now requesting a $250,000 Line of Credit and a new Term Loan in the amount of $300,000 to expand the capacity which is fully utilized now. The line of credit will enable her to take advantage of low points in the fluctuating price cycles of her main ingredients, such as flour, cocon, and sugar. She also wants to pay off the existing $200,000 line of credit and Term Loan at her preset bank. There is $130,000 outstanding under the Line of Credit and $351,620 outstanding under the Term Loan. In summary, the total request is $250,000 for a Line of Credit and a $651,620 Term Loan with $300,000 serving as new financing to expand existing operations. The proposed Term Loan will be amortized over 84 months with a 6% interest rate. The annual Principal and Interest payments will be $115,000. The Line of Credit will be priced at Prime + 1.0% Two of your bank's best customers have done business with her, and both give her Shop high marks. There are perhaps 20 baking companies in the Chicago metropolitan area Direct competition is limited, however, by the fact that cach sells a fairly distinct product line. This is especially true of Jeannie's, the Shop makes only flat cookies (no fancy designs), bakes to customer specifications, and produces the "Jeannie Classic" chocolate chip cookies, which are popular in the local market. Jcannie's customers include a large metropolitan supermarket chain, several regional convenience store chains, and numerous independent delis, restaurants, and grocery stores. Quality is certainly the most important factor in the cookie business. Cookies cannot be burnt or broken, and customers demand consistency of shape, size, and taste. Price is another important consideration. Although bakers produce a wide range of different cookies, the range of prices that buyers are willing to pay is narrow. Jeannie boasts, "I've been cooking all my life." She knows what people like, and her Shop has responded very well to the quality and price demands of her market. As mentioned above, most of her output is baked to customer specifications She sends samples to prospective buyers for their approval , willingly changes ingredients to obtain the proper taste for the desired cost, and, most importantly, personally advises her Jeanne's Cookie Shop 2 a customers in designing" cookies that meet their needs precisely. Few other cookie makers offer this personal service. Once the cookies have been designed, Jeannie personally supervises their production to assure high quality and to minimize costs. She checks random samples for texture, shape, and taste. Cost control is critical here, and Jeannie maintains close tolerances on all aspects of her products. Any batches of dough that do not meet her standards are remixed in a 25/75 ratio with fresh dough, baked, and sampled again. Any cookies that fall to the floor or break during production are sold as hog feed to farms in western Illinois. Clearly, nothing goes to waste in the entire operation. Jeannie's buys its ingredients from four main suppliers, all of which are giants in their industries and therefore dependable sources. Alternative suppliers do exist, but prices do not vary significantly, and Jeannie has developed a good working relationship with her suppliers. One benefit of this is that suppliers will wam Jeannie's in advance of possible strikes or shortages in their respective industries. As an additional security measure, Jeannie's has usually large storage facilities and generally maintains inventory sufficient for two months of production The labor situation at Jeannie's is good. All eight employees are members of the baker's union. They work five-hour days and are eager to work eight hours when needed. The union contract has two more years to run. Although strikes are highly unlikely, Jeannie and her husband, who is the Shop's bookkeeper, could almost run the operations themselves in a pinch. Production facilities are in excellent condition. The State Health Department makes frequent and unannounced inspections, and Jeannie's has been cited for only one violation in the 11 years since Jeannie bought it. The major component of the production process is a 100-foot-long conveyor, which does virtually everything but pack the cookies. About a year ago, an employee forgot to turn off the oven on this critical machine, and the continuous metal band melted. Fortunately, Jeannie had purchased interruption insurance for this machine, which paid for the repairs, and for her salary during the month of the downtime; it also covered the Shop's profits for the month, based on average output for the previous year. Selling its product is perhaps Jeannie's easiest task. The firm's advertising is entirely word-of-mouth, based largely on Jeannie's reputation for high quality, low prices, and personal service. Most customers are nearby and pick up the cookies in their own trucks directly from Jeannie's, thus saving freight costs for both themselves and Jeannie's. Jeannie's storage space for the finished cookies is minimal, since they are picked up within one or two days after baking. Costs are further minimized by Jeannie's tight credit policy. The large metropolitan supermarket chain is allowed 10-day terms, but all the smaller customers must pay 50 percent in advance (which covers virtually all of Jeannie's costs) and 50 percent on delivery. Sales tend to be steady except for large sales increases 3 Jeanne's Cookie Shop around Christmas. Jeannie is planning to add a full-time salesperson in the near future to expand the Shop's sales territory As far as product flexibility is concerned, Jeannie's has recently begun producing "Healthy Jeannie's," cookies made with oats, nuts, and fruit. This line currently makes up about 15 percent of output. The increased term loan Jeannie is requesting would be used to double the Shop's production capacity for these cookies. Of course, no business is without its problems. A major one for Jeannie's is a pending lawsuit brought by the previous owner of the Shop. At issue is a piece of machinery that, according to the former owner, was not properly part of the sale of assets. However, Jeannic has accounted for this contingency by making a deposit in a savings account to cover the disputed amount. Another problem that Jeannie's sometimes encounters is that very large orders (more than 250,000 units) can be filled more cheaply by one of the large industrial bakers. But because the number of Jeannie's smaller customers is growing fast enough to offset such losses easily, Jeannie maintains her strong advantage over all small and medium-sized bakeries. Ironically, Jeannie's fastest-growing competitor is the very supermarket chain that purchases its cookies. The chain has identified increasing demand for fresh bakery products and is in the process of opening in-house bakeries at all locations Management has assured Jeannie that her cookies will still be carried, and she feels confident that sales will continue to grow due to Jeannie's Cookie's name recognition and reputation for quality You are Jeannie's banker and must make a decision on her loan request. During your deliberations, there are several things you should consider. Please answer the following questions. In your response, be succinct, concise and to the point. Jeanne's Cookie Shop Your assignment is to thoroughly analyze Jeanne's Cookie Shop with the information provided and prepare a comprehensive, clear, concise, accurate and relevent credit presentation. In doing so, it may be helpful for you to answer the questions that follow. In your analysis, assume all supporting information you would ordinarily request to support a loan decision is in your possession and the results are satisfactory to your bank. 1. Common Size all accounts on the Balance Sheet and income Statement by completing the Balance Sheet and Income Statement Common Sizing Forms on page 6 and 7 respectively. Please record your Common Sized Factors directly on the Balance Sheet and income Statement. Also, round your answer to the nearest tenth of a percent and answer the following requirements, on a separate sheet: 2. What are the concentration of assets on the balance sheet and whether or not this concentration makes sense for this type of company? b. Explain any trends worth noting on the Balance Sheet c. On the Income Statement, explain the trends of the common sized values for the Gross Profit Margins. Operating Profit Margins and the Net Profit Margins and what is causing the changes in these margins. 2. Review the Net Sales by Month Report on page 8 and explain any trend and the possible reasons for the changes in Net Sales over a one year period. 3.Complete the Ratio Worksheet on page 9 and explain the meaning of each ratio and the trend of each ratio as it relates to this case. Jeanne's Cookie Shop 4. Complete the Uniform Cash Analysis for 2018 and 2019 on page 10. Please Explain: a. What are the primary sources and uses of Cash? b. Is there sufficient cash flow to service the annual Current Portion of Long Term Debt for 2019 and anticipated for 20202 c. What section of the Uniform Cash Analysis led you to your answer in 3(b)? Jeannie's Cookie Shop Balance Sheets (Uradne For Years Ended April 30 2017 2018 % 2019 X 5.405 356,765 ASSETS Current assets Cash Accounts receivable, trade Advances due from officers Inventories at cost Prepaid expenses and deposits Total current assets 18.965 385 870 15.000 249.740 20.419 689.985 166,510 472 940 128.750 184.725 37.435 990 360 196.900 18.385 576.455 420.000 91 350 6.100 517.450 45.000 472420 500.000 117.435 14.455 631.890 102.860 529,030 500 000 122.740 14 455 637,195 1674110 470,085 7.185 5.460 3.735 $1.056,060 $1 724 475 Equipment and improvements Machinery and equipment Furniture and Satures Leasehold improvements Gross property and equipment Less Accumulated depreciation Net equipment and improvements Organization and expense, less amortization TOTAL ASSETS UABILITIES AND STOCKHOLDERS' EQUITY Current liabilities Short-term notes payable Current portion LTO Accounts payable Accrued expenses Accrued federal taxes on income Dividend Payable Total current liabilities $1.484 180 150.000 75.185 142 610 81.970 0 0 449,785 75 000 88,110 133 115 52.030 0 30.000 398 255 130,000 86.405 204 700 31,310 117.500 569.975 290 880 345 615 265,215 Long-term debt, less current maturities Stockholders' equity Capital stock, issued and outstanding 750,000 shares Paid in capite Retained earnings Total stockholders' equity 187.500 112.500 15:35 315 395 187.500 112.500 160 FOS 480,605 187 500 112.500 328.990 628,990 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 1056 060 $1 224 475 $1.464 180 Jeannie's Cookie Shop Statements of Income and Retained Earnings (Unaudited) For Years Ended Apni 30 2017 % 2018 % 2019 % Sales Sales Discounts $2.238 815 22 990 2,215,825 1221.065 994 760 $3,017,200 27.925 2,989,275 1695.905 1.293,370 $4 228,760 36 390 4.192.370 2.265.005 1.927,385 Costs of goods sold Gross profit 68,160 Operating expenses Freight Officers' salaries Salaries and wages Payroll taxes Union pension and welfare Rent Auto and truck expense Advertising Depreciation Amortization Insurance Office supplies Professional services Equipment rental Repairs and maintenance Officers' we insurance Taxes and licenses Travel and entertainment Ublities Commissions Bad debts Micellaneous Total operating expenses Operating profit 43.815 193 250 341,655 44,530 29,535 56.450 9.465 530 39.905 1,725 19.380 9,130 6225 17.300 17,035 6,000 15.765 830 27,370 2,405 1.150 880 884.310 110,450 209.875 380,050 49.900 31,520 79,700 11.820 835 57 830 1.725 25,260 11.365 5,375 23.155 33 860 6,000 20.780 1650 37.765 6,510 7,080 3.180 1073.395 219,975 75,025 313 605 586.055 73.220 52.610 80 850 10,420 575 84 250 1,725 42,010 20.115 7.555 28 275 37.780 6,000 36,085 12 125 46,865 1.445 0 2.050 1498.640 428,725 1.030 12,165 99,315 25.015 29.780 215.210 2.575 15 415 415,885 Miscellaneous income Interest expense Net earnings before income tax income tax Net earnings 0 0 117.500 $99 315 $215,210 $298,385 Retained earnings at beginning of year Retained earnings at end of year Earnings per share (83,920) 15,395 0.13 $ 3,079 215 605 0.29 $ 46,121 528,990 0.40 % of Total 7.8 7.6 May 2018 June July August September October November December January February March April 2019 Jeannie's Cookie Shop Net Sales by Month For Year Ended April 30, 2019 327,005 320,250 302,230 293,465 301,470 440,200 410 850 465,355 316.990 306,045 339 368.930 7.2 7.0 72 10.5 9.8 11.1 7.6 7.3 Total $ 4,192,370 100.0% 8 RATIO WORKSHEET JEANNE'S COOKIE SHOP 2017 2018 2019 Sales Growth % Working Capital Current Ratio Quick Ratio Leverage Ratio (Debt/Worth) Sales-to-Assets Sales to Net Fixed Assets Net Fixed Assets Usage Ratio Net Fixed Asset Life Ratio Inventory Tumover (days) Receivable Turnover (days) Payable Tumover (days) Return on Equity Retum on Assets Gross Profit Margin Operating Profit Margin Net Protit Margin 1 Sales Revneue (net) 2 Accounts Receivable 3 Cash collected from sales (1 : 2) 4 Cost of goods sold (less noncash COGS) 5 "inventory 6 Accounts payable 7 Cash paid for production (Sum 4,5,6) Cash from trading activities ( 3 +7) 9 SG&A expense (less noncash SG&A) 10 Prepaid expenses 11 Accrued expenses 12 Cash paid for operating costs (Sum 9,10,11) Cash after operations (8 +12) 8 13 14 Other Income (expense) 15 "Other current and noncurrent accounts 16 Income tax expense 17 Deferred income taxes 18 "Income taxes payable 19 Taxes/other income (expenseSum 14-18) 20 Net cash after operations (13 - 19) 21 Interest expense 22 "Interest payable 23 Dividends declared or owner's withdrawals 24 "Dividends payable 25 Paid for dividends and interest (Sum 21-24) 26 Cash after financing costs (20 + 25) 27 Current portion long-term debt (prior year) 28 Cash after debt amortization (26 + 27) 29 Fixed assets 30 "Investments 31 "Intangibles 32 Paid for plant and investments (Sum 29-31) 33 Financing surplus (requirement) (28+32) 34 "Short-term debt (notes payable) 35 "Long-term debt 36 Preferred stock 37 "Common stock 38 Paid In Capital 39 Total external financing (Sum 34-38) 40 Financing surplus (requirement)(33+39) 41 Proof: 'Cash and marketable securities 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts