Question: 3. (25pt) A US Treasury bond (face value =$100 ) for settlement 3 July 2022 that matures on 15 November 2023 . The coupon rate

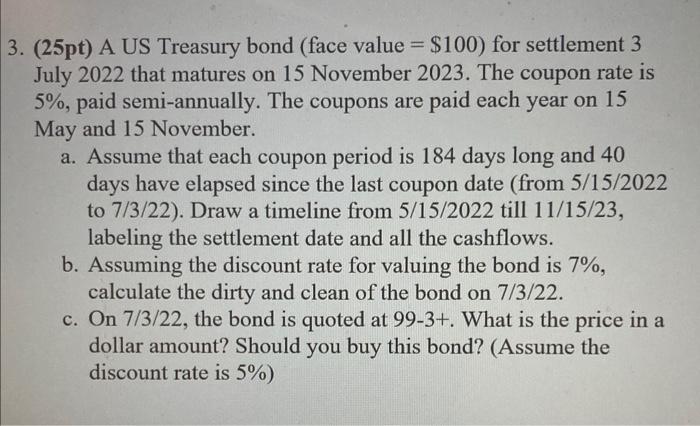

3. (25pt) A US Treasury bond (face value =$100 ) for settlement 3 July 2022 that matures on 15 November 2023 . The coupon rate is 5%, paid semi-annually. The coupons are paid each year on 15 May and 15 November. a. Assume that each coupon period is 184 days long and 40 days have elapsed since the last coupon date (from 5/15/2022 to 7/3/22 ). Draw a timeline from 5/15/2022 till 11/15/23, labeling the settlement date and all the cashflows. b. Assuming the discount rate for valuing the bond is 7%, calculate the dirty and clean of the bond on 7/3/22. c. On 7/3/22, the bond is quoted at 993+. What is the price in a dollar amount? Should you buy this bond? (Assume the discount rate is 5%) 3. (25pt) A US Treasury bond (face value =$100 ) for settlement 3 July 2022 that matures on 15 November 2023 . The coupon rate is 5%, paid semi-annually. The coupons are paid each year on 15 May and 15 November. a. Assume that each coupon period is 184 days long and 40 days have elapsed since the last coupon date (from 5/15/2022 to 7/3/22 ). Draw a timeline from 5/15/2022 till 11/15/23, labeling the settlement date and all the cashflows. b. Assuming the discount rate for valuing the bond is 7%, calculate the dirty and clean of the bond on 7/3/22. c. On 7/3/22, the bond is quoted at 993+. What is the price in a dollar amount? Should you buy this bond? (Assume the discount rate is 5%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts