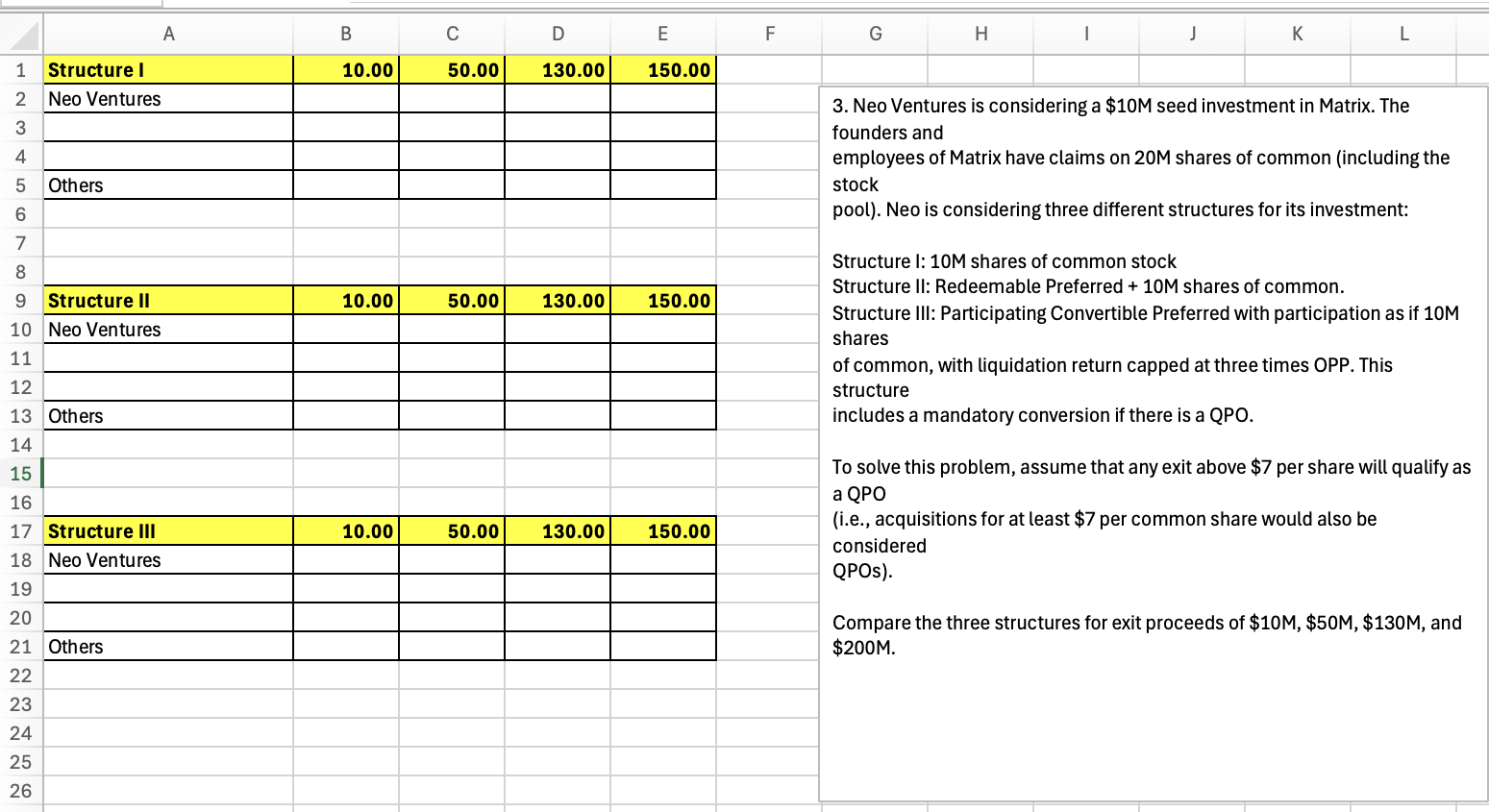

Question: 3 . 3 . Neo Ventures is considering a $ 1 0 M seed investment in Matrix. The founders and employees of Matrix have claims

Neo Ventures is considering a $M seed investment in Matrix. The founders and

employees of Matrix have claims on M shares of common including the stock

pool Neo is considering three different structures for its investment:

Structure I: M shares of common stock

Structure II: Redeemable Preferred M shares of common.

Structure III: Participating Convertible Preferred with participation as if M shares

of common, with liquidation return capped at three times OPP. This structure

includes a mandatory conversion if there is a QPO.

To solve this problem, assume that any exit above $ per share will qualify as a QPO

ie acquisitions for at least $ per common share would also be considered

QPOs

Compare the three structures for exit proceeds of $M $M $M and $M

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock