Question: 3 3 points During the current year, Rayon Corporation disposed of two different assets. On January 1, prior to their disposal, the accounts reflected

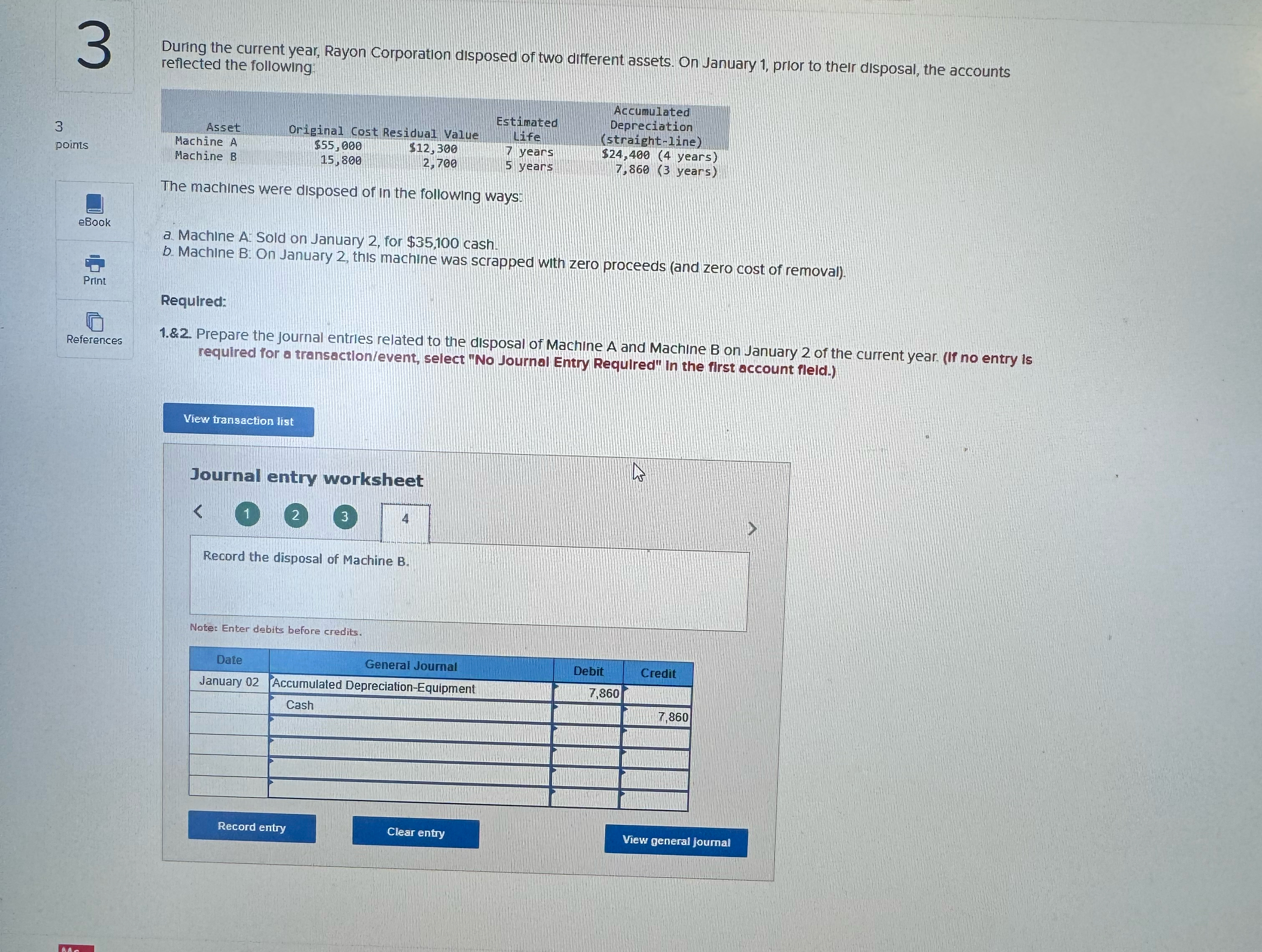

3 3 points During the current year, Rayon Corporation disposed of two different assets. On January 1, prior to their disposal, the accounts reflected the following Accumulated Asset Machine A Machine B Original Cost Residual Value Estimated Life $55,000 15,800 $12,300 2,700 7 years 5 years Depreciation (straight-line) $24,400 (4 years) 7,860 (3 years) eBook Print References The machines were disposed of in the following ways: a. Machine A Sold on January 2, for $35,100 cash. b. Machine B. On January 2, this machine was scrapped with zero proceeds (and zero cost of removal). Required: 1.&2. Prepare the journal entries related to the disposal of Machine A and Machine B on January 2 of the current year. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction list Journal entry worksheet < 2 3 4 Record the disposal of Machine B. Note: Enter debits before credits. Date General Journal Debit Credit January 02 Accumulated Depreciation-Equipment 7,860 Cash 7,860 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts