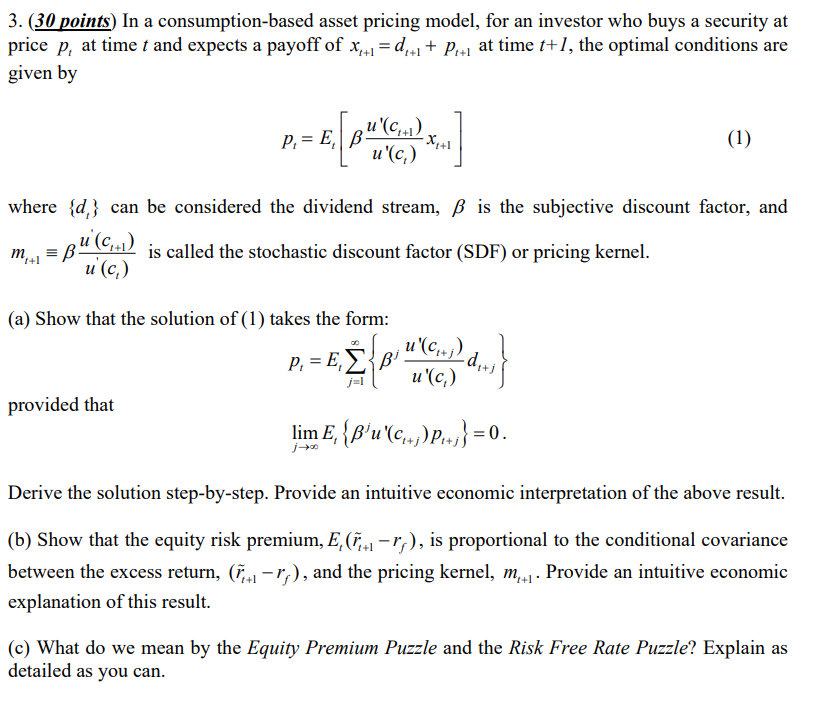

Question: 3. (30 points) In a consumption-based asset pricing model, for an investor who buys a security at price p, at time t and expects a

3. (30 points) In a consumption-based asset pricing model, for an investor who buys a security at price p, at time t and expects a payoff of x+1 = 0,-1+ P+1 at time t+1, the optimal conditions are given by P,= E, B4%(cm) x ( u u'(c) (1) where {d} can be considered the dividend stream, B is the subjective discount factor, and m1 = pu (C=1) is called the stochastic discount factor (SDF) or pricing kernel. u (c) = + (a) Show that the solution of (1) takes the form: , = .{' P. = u'(C+;) u'(c) in) dit provided that lim E,{b'u'(c +;) Pc+;}=0. = ;** Derive the solution step-by-step. Provide an intuitive economic interpretation of the above result. (b) Show that the equity risk premium, E, (7.-1-ry), is proportional to the conditional covariance between the excess return, (+1 r;), and the pricing kernel, m,+1. Provide an intuitive economic explanation of this result. (c) What do we mean by the Equity Premium Puzzle and the Risk Free Rate Puzzle? Explain as detailed as you can. 3. (30 points) In a consumption-based asset pricing model, for an investor who buys a security at price p, at time t and expects a payoff of x+1 = 0,-1+ P+1 at time t+1, the optimal conditions are given by P,= E, B4%(cm) x ( u u'(c) (1) where {d} can be considered the dividend stream, B is the subjective discount factor, and m1 = pu (C=1) is called the stochastic discount factor (SDF) or pricing kernel. u (c) = + (a) Show that the solution of (1) takes the form: , = .{' P. = u'(C+;) u'(c) in) dit provided that lim E,{b'u'(c +;) Pc+;}=0. = ;** Derive the solution step-by-step. Provide an intuitive economic interpretation of the above result. (b) Show that the equity risk premium, E, (7.-1-ry), is proportional to the conditional covariance between the excess return, (+1 r;), and the pricing kernel, m,+1. Provide an intuitive economic explanation of this result. (c) What do we mean by the Equity Premium Puzzle and the Risk Free Rate Puzzle? Explain as detailed as you can

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts