Question: 3 & 4 please Question 3 2 pts Aln) 9.8% bond with 6 years left to maturity has a YTM of 9.1%. The bond's price

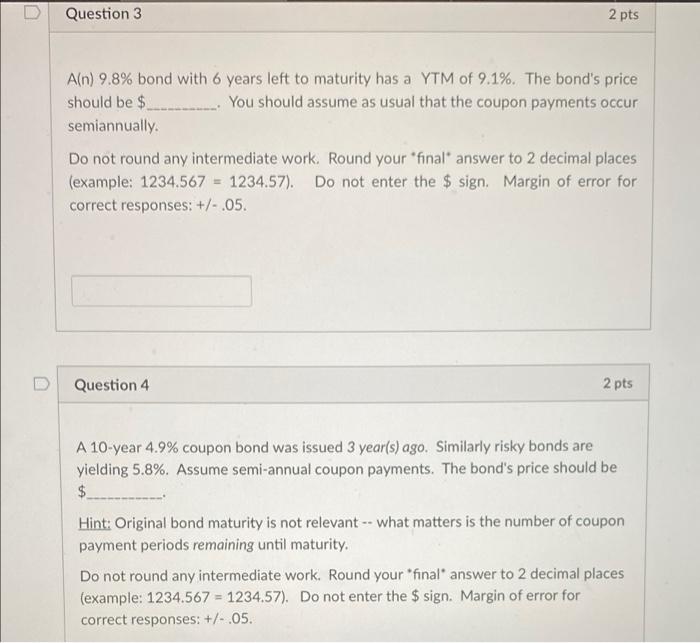

Question 3 2 pts Aln) 9.8% bond with 6 years left to maturity has a YTM of 9.1%. The bond's price should be $........... You should assume as usual that the coupon payments occur semiannually. Do not round any intermediate work. Round your final answer to 2 decimal places (example: 1234.567 = 1234.57). Do not enter the $ sign. Margin of error for correct responses: +/-.05. Question 4 2 pts A 10-year 4.9% coupon bond was issued 3 year(s) ago. Similarly risky bonds are yielding 5.8%. Assume semi-annual coupon payments. The bond's price should be $ Hint: Original bond maturity is not relevant -- what matters is the number of coupon payment periods remaining until maturity. Do not round any intermediate work. Round your final answer to 2 decimal places (example: 1234.567 = 1234.57). Do not enter the $ sign. Margin of error for correct responses: +/-.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts