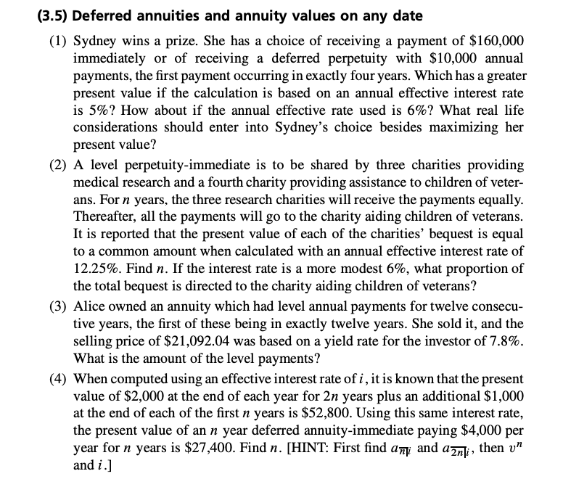

Question: ( 3 . 5 ) Deferred annuities and annuity values on any date ( 1 ) Sydney wins a prize. She has a choice of

Deferred annuities and annuity values on any date

Sydney wins a prize. She has a choice of receiving a payment of $

immediately or of receiving a deferred perpetuity with $ annual

payments, the first payment occurring in exactly four years. Which has a greater

present value if the calculation is based on an annual effective interest rate

is How about if the annual effective rate used is What real life

considerations should enter into Sydney's choice besides maximizing her

present value?

A level perpetuityimmediate is to be shared by three charities providing

medical research and a fourth charity providing assistance to children of veter

ans. For years, the three research charities will receive the payments equally.

Thereafter, all the payments will go to the charity aiding children of veterans.

It is reported that the present value of each of the charities' bequest is equal

to a common amount when calculated with an annual effective interest rate of

Find If the interest rate is a more modest what proportion of

the total bequest is directed to the charity aiding children of veterans?

Alice owned an annuity which had level annual payments for twelve consecu

tive years, the first of these being in exactly twelve years. She sold it and the

selling price of $ was based on a yield rate for the investor of

What is the amount of the level payments?

When computed using an effective interest rate of it is known that the present

value of $ at the end of each year for years plus an additional $

at the end of each of the first years is $ Using this same interest rate,

the present value of an year deferred annuityimmediate paying $ per

year for years is $ Find HINT: First find and then

and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock