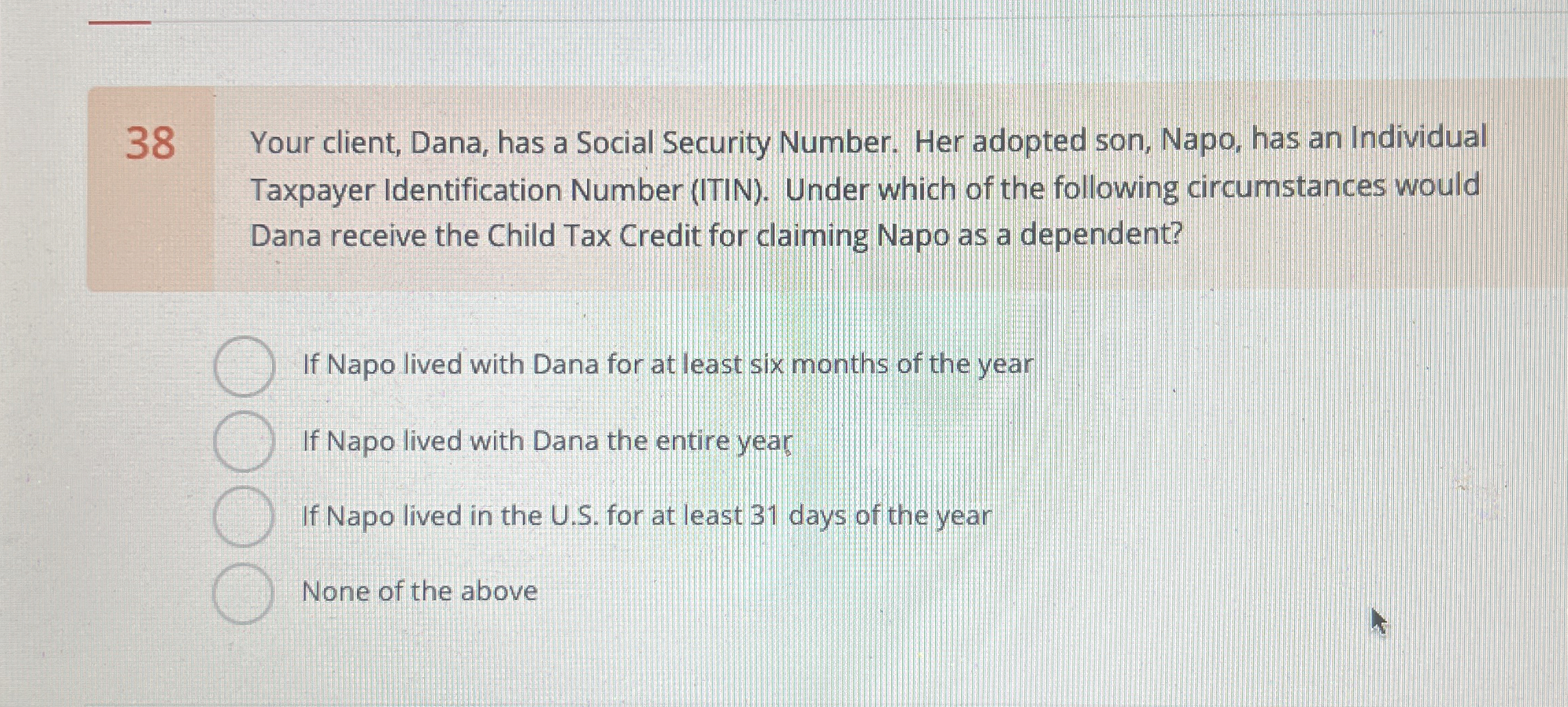

Question: 3 8 Your client, Dana, has a Social Security Number. Her adopted son, Napo, has an Individual Taxpayer Identification Number ( ITIN ) . Under

Your client, Dana, has a Social Security Number. Her adopted son, Napo, has an Individual

Taxpayer Identification Number ITIN Under which of the following circumstances would

Dana receive the Child Tax Credit for claiming Napo as a dependent?

If Napo lived with Dana for at least six months of the year

If Napo lived with Dana the entire year

If Napo lived in the US for at least days of the year

None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock