Question: 3. (a) (b) (c) Discuss the different measures used for computing price volatility. When using Duration why do you need to correct for convexity?

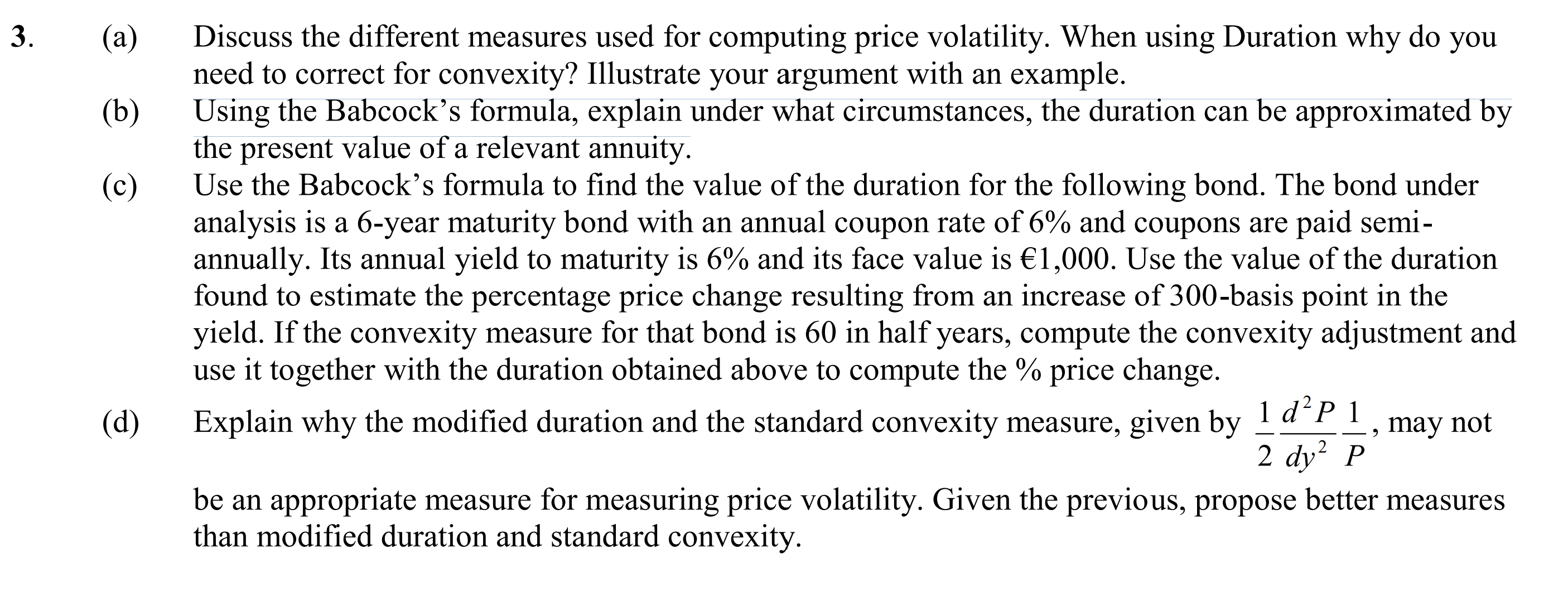

3. (a) (b) (c) Discuss the different measures used for computing price volatility. When using Duration why do you need to correct for convexity? Illustrate your argument with an example. Using the Babcock's formula, explain under what circumstances, the duration can be approximated by the present value of a relevant annuity. Use the Babcock's formula to find the value of the duration for the following bond. The bond under analysis is a 6-year maturity bond with an annual coupon rate of 6% and coupons are paid semi- annually. Its annual yield to maturity is 6% and its face value is 1,000. Use the value of the duration found to estimate the percentage price change resulting from an increase of 300-basis point in the yield. If the convexity measure for that bond is 60 in half years, compute the convexity adjustment and use it together with the duration obtained above to compute the % price change. Explain why the modified duration and the standard convexity measure, given by (d) 1 d P 1 2 dy P may not be an appropriate measure for measuring price volatility. Given the previous, propose better measures than modified duration and standard convexity.

Step by Step Solution

3.30 Rating (153 Votes )

There are 3 Steps involved in it

3 a Measures of Price Volatility and the Need for Convexity Correction Measures of Price Volatility 1 Standard Deviation It measures the dispersion of a bonds price returns around its mean A higher st... View full answer

Get step-by-step solutions from verified subject matter experts