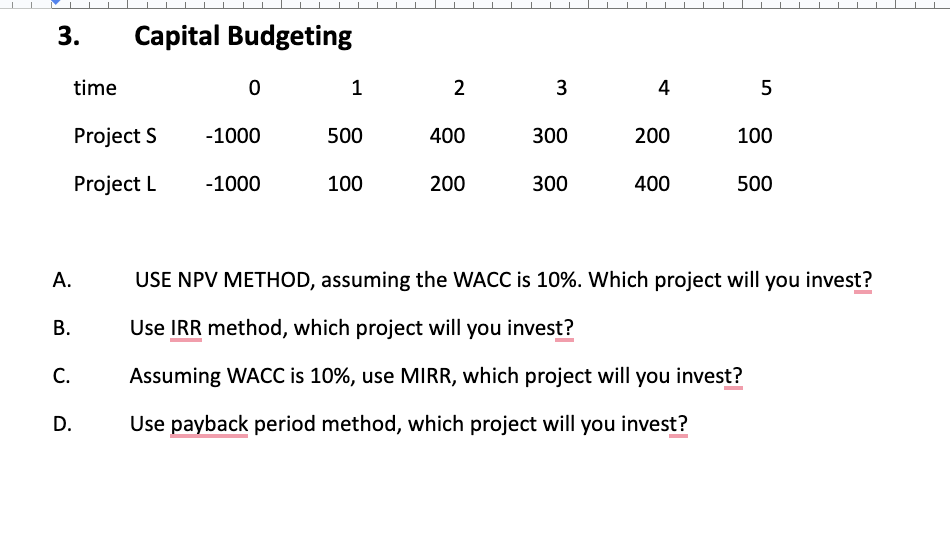

Question: 3. A. B. C. time Capital Budgeting Project S Project L D. 0 -1000 -1000 1 500 100 2 400 200 3 300 300

3. A. B. C. time Capital Budgeting Project S Project L D. 0 -1000 -1000 1 500 100 2 400 200 3 300 300 4 200 400 5 100 500 USE NPV METHOD, assuming the WACC is 10%. Which project will you invest? Use IRR method, which project will you invest? Assuming WACC is 10%, use MIRR, which project will you invest? Use payback period method, which project will you invest?

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

The image youve shared contains a table with cash flows for two different projects Project S and Project L over a period from time 0 to time 5 Each project requires an initial investment of 1000 and t... View full answer

Get step-by-step solutions from verified subject matter experts