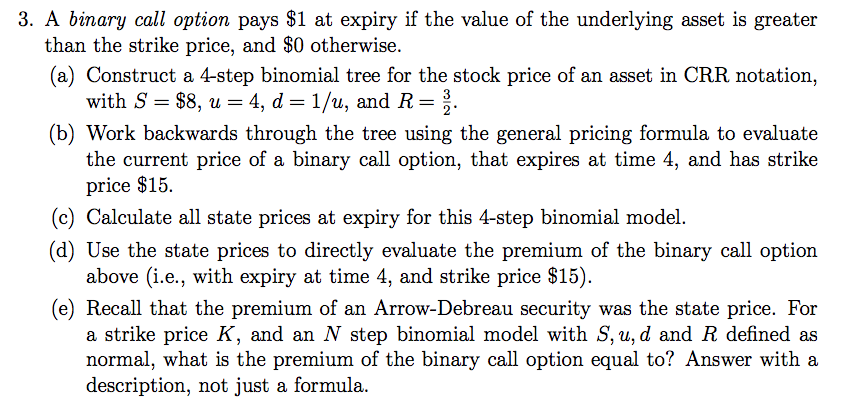

Question: 3. A binary call option pays $1 at expiry if the value of the underlying asset is greater than the strike price, and $0 otherwise.

3. A binary call option pays $1 at expiry if the value of the underlying asset is greater than the strike price, and $0 otherwise. (a) Construct a 4-step binomial tree for the stock price of an asset in CRR notation, with S=$8, u = 4, d=1/u, and R= (b) Work backwards through the tree using the general pricing formula to evaluate the current price of a binary call option, that expires at time 4, and has strike price $15. (c) Calculate all state prices at expiry for this 4-step binomial model. (d) Use the state prices to directly evaluate the premium of the binary call option above (i.e., with expiry at time 4, and strike price $15). () Recall that the premium of an Arrow-Debreau security was the state price. For a strike price K, and an N step binomial model with S, u, d and R defined as normal, what is the premium of the binary call option equal to? Answer with a description, not just a formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts