Question: 3. a) Consider the following three shares: Eagle Plc is expected to provide a dividend of Shs 60/= per share per year forever, starting three

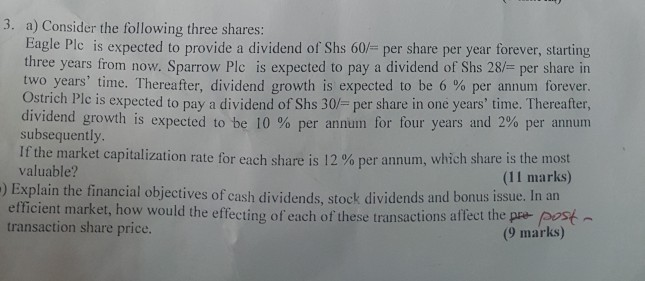

3. a) Consider the following three shares: Eagle Plc is expected to provide a dividend of Shs 60/= per share per year forever, starting three years from now. Sparrow Plc is expected to pay a dividend of Shs 28/= per share in two years' time. Thereafter, dividend growth is expected to be 6% per annum forever. Ostrich Ple is expected to pay a dividend of Shs 30/= per share in one years' time. Thereafter, dividend growth is expected to be 10 % per annum for four years and 2% per annum subsequently, It the market capitalization rate for ench share is 12% per annum, which share is the most valuable? (11 marks) Explain the financial objectives of cash dividends, stock dividends and bonus issue. In an efficient market, how would the effecting of each of these transactions allect the pre pot transaction share price. (9 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts