Question: ABC Corp. invests ( $ 500,000 ) this year in a five-year project. The investment will have the salvage value of ( $ 35,000 ).

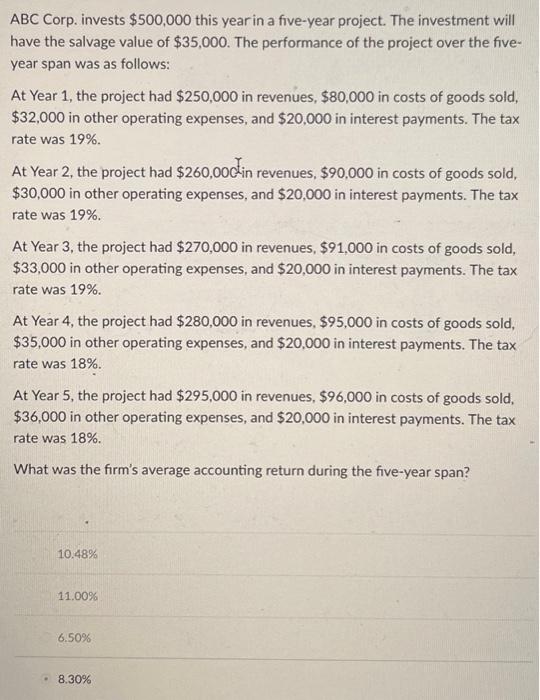

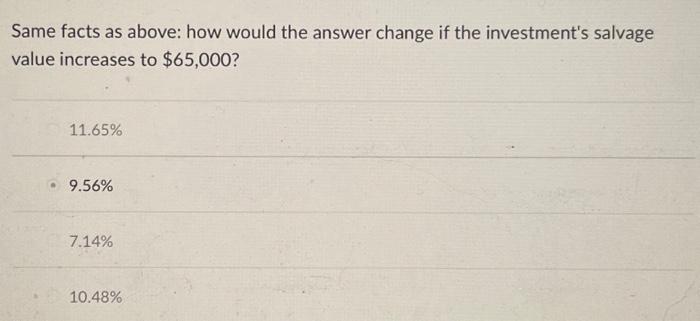

ABC Corp. invests \\( \\$ 500,000 \\) this year in a five-year project. The investment will have the salvage value of \\( \\$ 35,000 \\). The performance of the project over the fiveyear span was as follows: At Year 1 , the project had \\( \\$ 250,000 \\) in revenues, \\( \\$ 80,000 \\) in costs of goods sold, \\( \\$ 32,000 \\) in other operating expenses, and \\( \\$ 20,000 \\) in interest payments. The tax rate was \19. At Year 2, the project had \\( \\$ 260,00 \\) chin revenues, \\( \\$ 90,000 \\) in costs of goods sold, \\( \\$ 30,000 \\) in other operating expenses, and \\( \\$ 20,000 \\) in interest payments. The tax rate was \19. At Year 3, the project had \\( \\$ 270,000 \\) in revenues, \\( \\$ 91,000 \\) in costs of goods sold, \\( \\$ 33,000 \\) in other operating expenses, and \\( \\$ 20,000 \\) in interest payments. The tax rate was \19. At Year 4 , the project had \\( \\$ 280,000 \\) in revenues, \\( \\$ 95,000 \\) in costs of goods sold, \\( \\$ 35,000 \\) in other operating expenses, and \\( \\$ 20,000 \\) in interest payments. The \\( \\operatorname{tax} \\) rate was \18. At Year 5, the project had \\( \\$ 295,000 \\) in revenues, \\( \\$ 96,000 \\) in costs of goods sold, \\( \\$ 36,000 \\) in other operating expenses, and \\( \\$ 20,000 \\) in interest payments. The \\( \\operatorname{tax} \\) rate was \18. What was the firm's average accounting return during the five-year span? \10.48 \11.00 \6.50 \8.30 Same facts as above: how would the answer change if the investment's salvage value increases to \\( \\$ 65,000 \\) ? \11.65 \9.56 \7.14 \10.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts