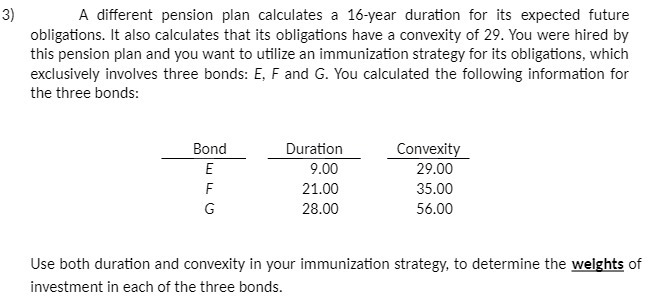

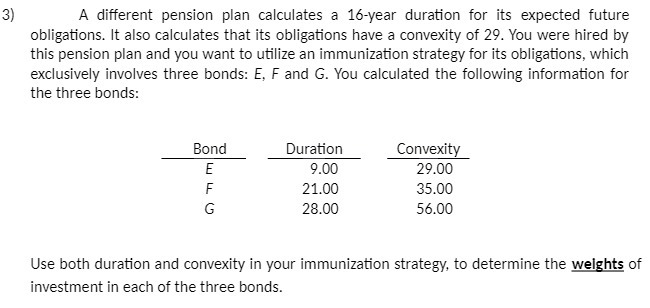

Question: 3) A different pension plan calculates a 16-year duration for its expected future obligations. It also calculates that its obligations have a convexity of 29.

3) A different pension plan calculates a 16-year duration for its expected future obligations. It also calculates that its obligations have a convexity of 29. You were hired by this pension plan and you want to utilize an immunization strategy for its obligations, which exclusively involves three bonds: E, F and G. You calculated the following information for the three bonds: Bond Duration Convexity 9.00 29.00 w LL O 21.00 35.00 28.00 56.00 Use both duration and convexity in your immunization strategy, to determine the weights of investment in each of the three bonds

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock