Question: What is the detailed solution to this question? A different pension plan calculates a 16-year duration for its expected future obligations. It also calculates that

What is the detailed solution to this question?

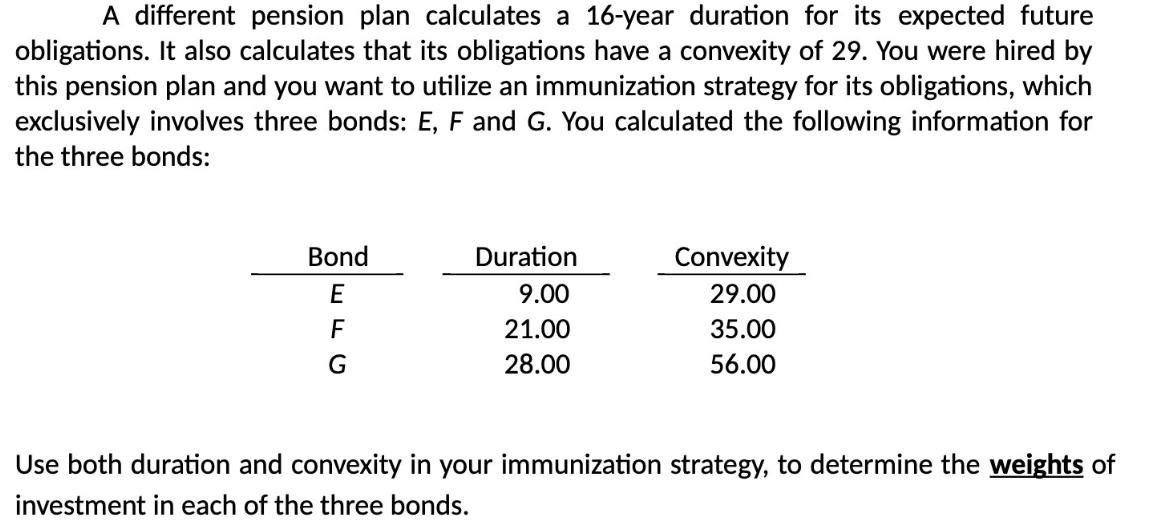

A different pension plan calculates a 16-year duration for its expected future obligations. It also calculates that its obligations have a convexity of 29. You were hired by this pension plan and you want to utilize an immunization strategy for its obligations, which exclusively involves three bonds: E, F and G. You calculated the following information for the three bonds: Bond E F G Duration 9.00 21.00 28.00 Convexity 29.00 35.00 56.00 Use both duration and convexity in your immunization strategy, to determine the weights of investment in each of the three bonds.

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

The steps on how to use both duration and convexity in an immunization strategy to determine the wei... View full answer

Get step-by-step solutions from verified subject matter experts