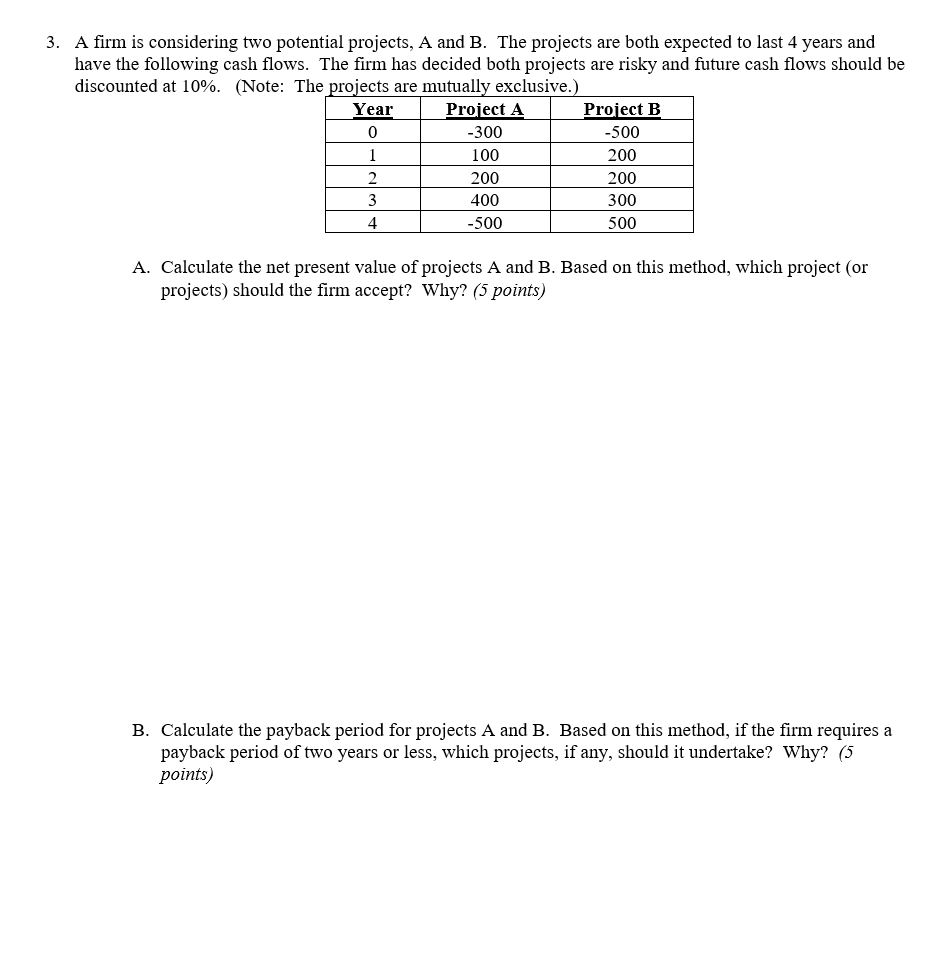

Question: 3. A firm is considering two potential projects, A and B. The projects are both expected to last 4 years and have the following cash

3. A firm is considering two potential projects, A and B. The projects are both expected to last 4 years and have the following cash flows. The firm has decided both projects are risky and future cash flows should be discounted at 10%. (Note: The projects are mutually exclusive.) Year Project A Project B 0 -300 -500 100 200 200 200 400 300 -500 500 1 2 4 A. Calculate the net present value of projects A and B. Based on this method, which project (or projects) should the firm accept? Why? (5 points) B. Calculate the payback period for projects A and B. Based on this method, if the firm requires a payback period of two years or less, which projects, if any, should it undertake? Why? (5 points) C. Calculate the profitability index for projects A and B. Based on this method, which project (or projects) should the firm accept? Why? (5 points) D. Calculate the discounted payback period for projects A and B. Based on this method, if the firm requires a discounted payback period of three years or less, which projects, if any, should the firm undertake? (5 points) E. Based on all of the calculations, which project or projects, if any, would you recommend? Why? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts