Question: 3. A firm is evaluating two competing projects. The first is a new inorganic chemicals plant, while the second is the expansion of a textile

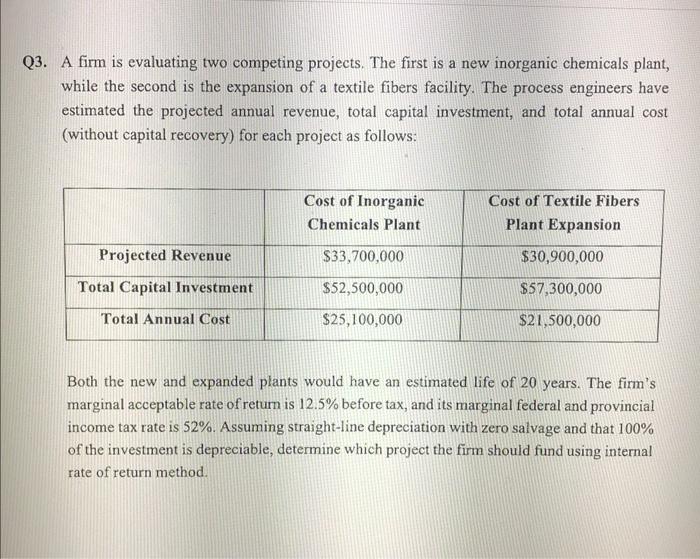

3. A firm is evaluating two competing projects. The first is a new inorganic chemicals plant, while the second is the expansion of a textile fibers facility. The process engineers have estimated the projected annual revenue, total capital investment, and total annual cost (without capital recovery) for each project as follows: Both the new and expanded plants would have an estimated life of 20 years. The firm's marginal acceptable rate of return is 12.5% before tax, and its marginal federal and provincial income tax rate is 52%. Assuming straight-line depreciation with zero salvage and that 100% of the investment is depreciable, determine which project the firm should fund using internal rate of return method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts