Question: Answer quickly for thumbs up 1. A firm is evaluating two competing projects. The first is a new inorganic chemicals plant, while the second is

Answer quickly for thumbs up

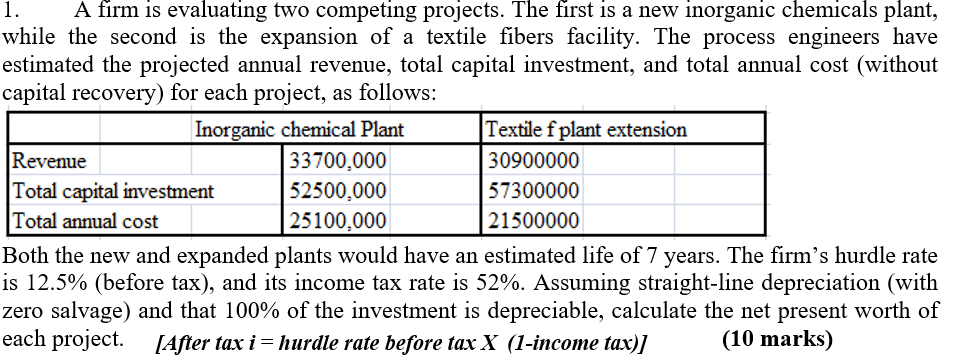

1. A firm is evaluating two competing projects. The first is a new inorganic chemicals plant, while the second is the expansion of a textile fibers facility. The process engineers have estimated the projected annual revenue, total capital investment, and total annual cost (without capital recovery) for each project, as follows: Both the new and expanded plants would have an estimated life of 7 years. The firm's hurdle rate is 12.5% (before tax), and its income tax rate is 52%. Assuming straight-line depreciation (with zero salvage) and that 100% of the investment is depreciable, calculate the net present worth of each project. [After tax i= hurdle rate before tax X (1-income tax)] (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts