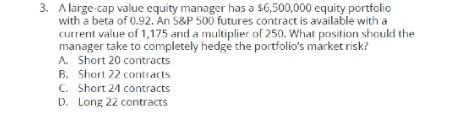

Question: 3. A large-cap value cquity manager has a $6,500,000 equity portfolio with a beta of 0.92. An S&P 500 futures contract is available with a

3. A large-cap value cquity manager has a $6,500,000 equity portfolio with a beta of 0.92. An S&P 500 futures contract is available with a current value of 1,175 and a multiplier of 250. What position should the manager take to completely hedge the portfolio's market risk? A. Short 20 contracts B. Short 22 contracts C. Short 24 contracts D. Long 22 contracts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock