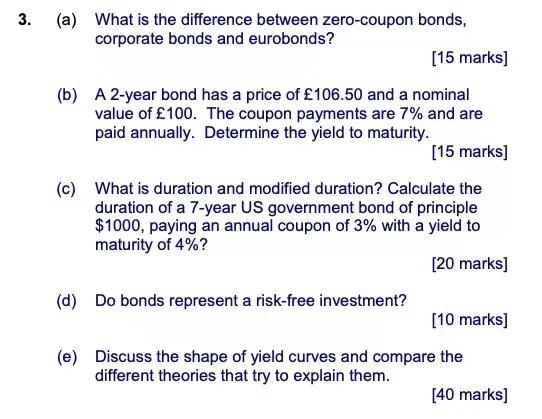

Question: 3. (a) What is the difference between zero-coupon bonds, corporate bonds and eurobonds? [15 marks] (b) A 2-year bond has a price of 106.50 and

3. (a) What is the difference between zero-coupon bonds, corporate bonds and eurobonds? [15 marks] (b) A 2-year bond has a price of 106.50 and a nominal value of 100. The coupon payments are 7% and are paid annually. Determine the yield to maturity. [15 marks] (c) What is duration and modified duration? Calculate the duration of a 7-year US government bond of principle $1000, paying an annual coupon of 3% with a yield to maturity of 4%? [20 marks] (d) Do bonds represent a risk-free investment? [10 marks] (e) Discuss the shape of yield curves and compare the different theories that try to explain them. [40 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts