Question: 3. (a) Within the Binomial Tree model, describe the dynamic of the spot price and explain the risk-neutral valuation approach to valuing a European

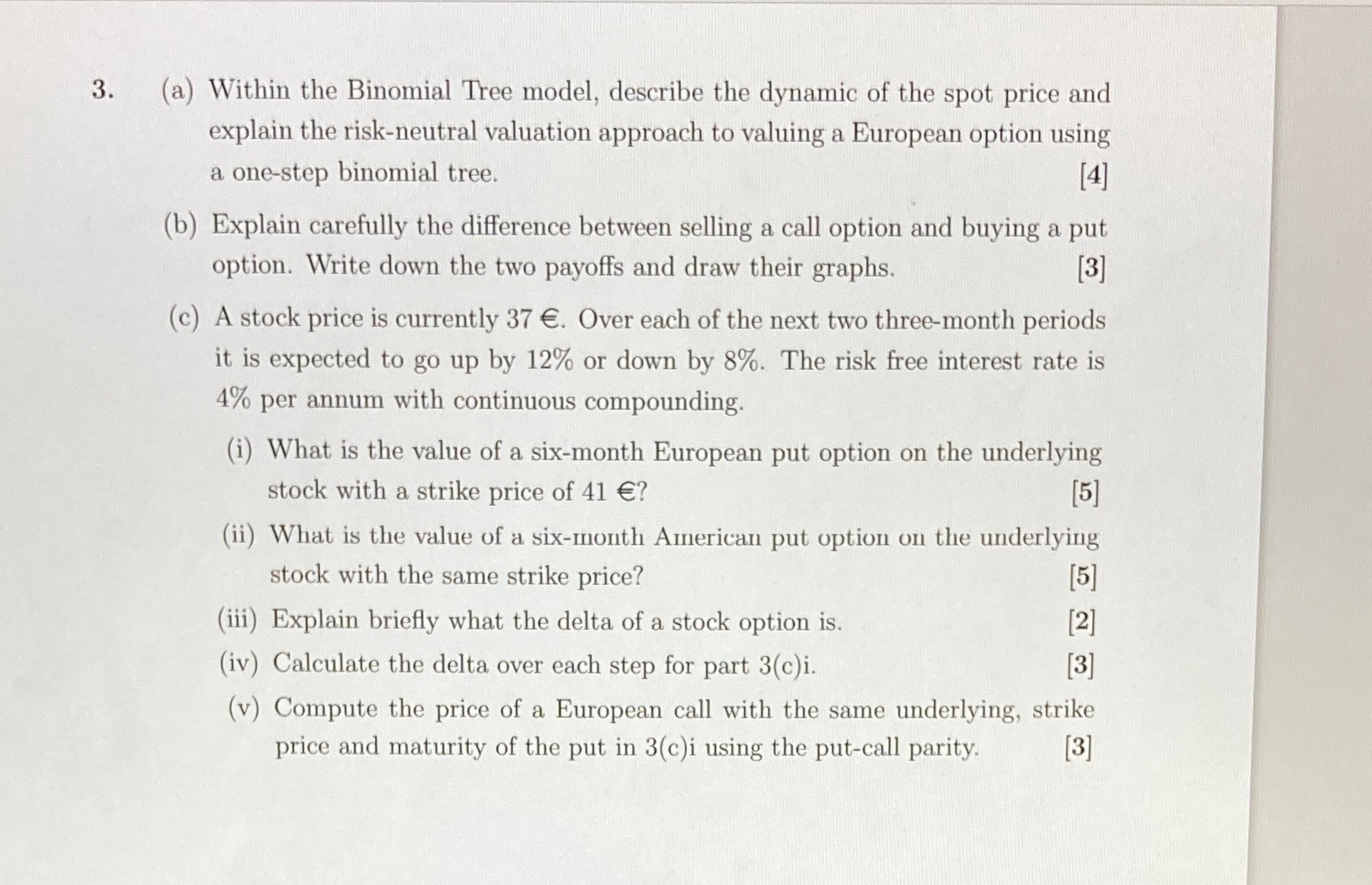

3. (a) Within the Binomial Tree model, describe the dynamic of the spot price and explain the risk-neutral valuation approach to valuing a European option using a one-step binomial tree. [4] (b) Explain carefully the difference between selling a call option and buying a put option. Write down the two payoffs and draw their graphs. [3] (c) A stock price is currently 37 . Over each of the next two three-month periods it is expected to go up by 12% or down by 8%. The risk free interest rate is 4% per annum with continuous compounding. (i) What is the value of a six-month European put option on the underlying stock with a strike price of 41 ? [5] (ii) What is the value of a six-month American put option on the underlying stock with the same strike price? [5] (iii) Explain briefly what the delta of a stock option is. [2] (iv) Calculate the delta over each step for part 3(c)i. [3] (v) Compute the price of a European call with the same underlying, strike price and maturity of the put in 3(c)i using the put-call parity. [3]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts