Question: 3. Based on the returns on two different assets A and B, suggest a portfolio that will have the least possible isk and greatest return.

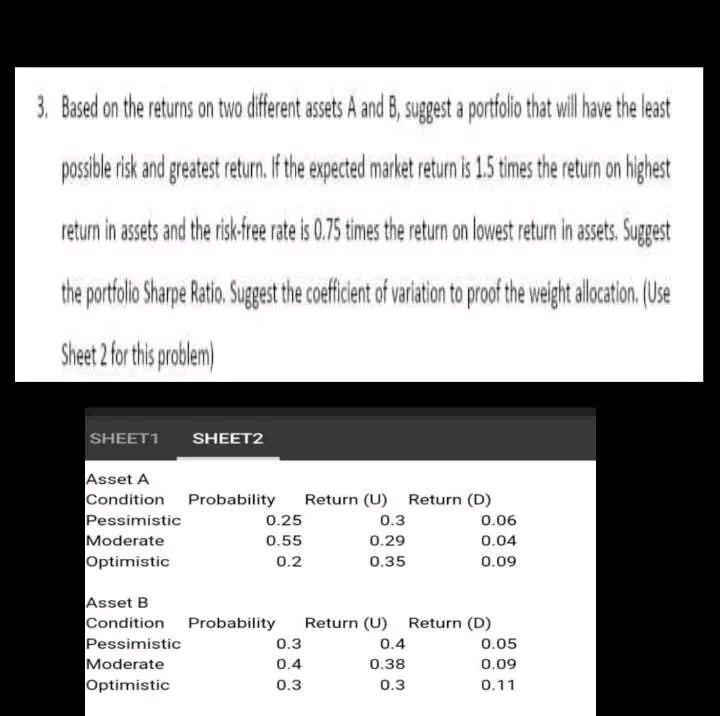

3. Based on the returns on two different assets A and B, suggest a portfolio that will have the least possible isk and greatest return. If the expected market return is 1.5 times the return on highest return in assets and the risk. free rate is 0.75 times the return on lowest return in assets. Sugrest the porttolio Sharpe Ratio. Suggest the coefficient of variation to proof the weight allocation. (Use Sheet 2 for this problem)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts