Question: 3) Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax

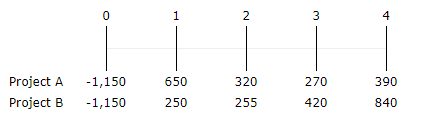

3) Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 12%.

What is Project As IRR? Do not round intermediate calculations. Round your answer to two decimal places. ___ %

What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. ____%

If the projects were independent, which project(s) would be accepted according to the IRR method? Neither / Project A/ Project B/ Boths project A and B

If the projects were mutually exclusive, which project(s) would be accepted according to the IRR method? Neither / Project A/ Project B/ Boths project A and B

Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? yes or no

The reason is the NPV and IRR approaches use the same reinvestment rate assumption and so both approaches reach the same project acceptance when mutually exclusive projects are considered or The NPV and IRR approaches use different reinvestment rate assumptions and so there can be a conflict in project acceptance when mutually exclusive projects are considered.

Reinvestment at the IRR/WACC is the superior assumption, so when mutually exclusive projects are evaluated the NPV/ IRR approach should be used for the capital budgeting decision.

0 1 N 3 4 650 390 Project A Project B -1,150 -1,150 320 255 270 420 250 840

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts