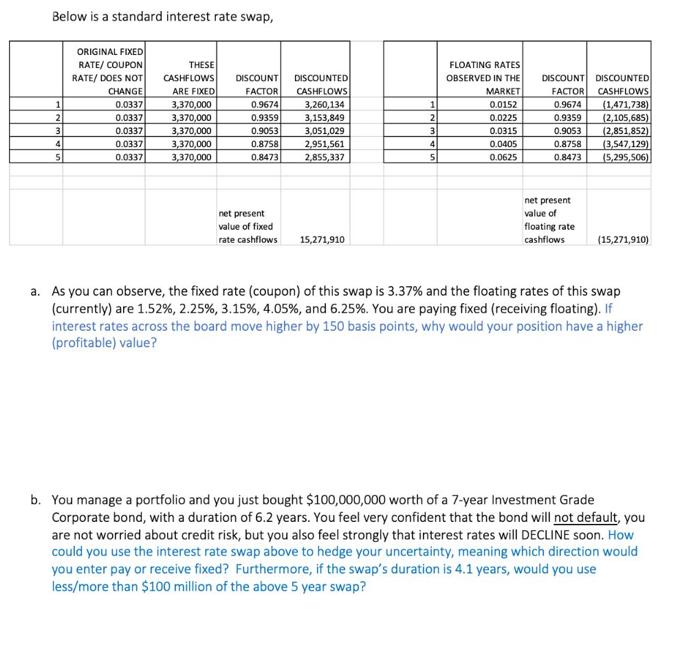

Question: Below is a standard interest rate swap, ORIGINAL FIXED RATE/ COUPON RATE/ DOES NOT 1 2 3 4 5 CHANGE 0.0337 0.0337 0.0337 0.0337

Below is a standard interest rate swap, ORIGINAL FIXED RATE/ COUPON RATE/ DOES NOT 1 2 3 4 5 CHANGE 0.0337 0.0337 0.0337 0.0337 0.0337 THESE CASHFLOWS DISCOUNT DISCOUNTED ARE FIXED FACTOR CASHFLOWS 3,370,000 3,260,134 3,370,000 3,153,849 3,370,000 3,051,029 2,951,561 3,370,000 3,370,000 2,855,337 0.9674 0.9359 0.9053 0.8758 0.8473 net present value of fixed rate cashflows 15,271,910 1 2 3 4 5 FLOATING RATES OBSERVED IN THE MARKET 0.0152 0.0225 0.0315 0.0405 0.0625 DISCOUNT DISCOUNTED FACTOR CASHFLOWS 0.9674 (1,471,738) 0.9359 (2,105,685) 0.9053 (2,851,852) 0.8758 (3,547,129) 0.8473 (5,295,506) net present value of floating rate cashflows (15,271,910) a. As you can observe, the fixed rate (coupon) of this swap is 3.37% and the floating rates of this swap (currently) are 1.52%, 2.25%, 3.15%, 4.05%, and 6.25%. You are paying fixed (receiving floating). If interest rates across the board move higher by 150 basis points, why would your position have a higher (profitable) value? b. You manage a portfolio and you just bought $100,000,000 worth of a 7-year Investment Grade Corporate bond, with a duration of 6.2 years. You feel very confident that the bond will not default, you are not worried about credit risk, but you also feel strongly that interest rates will DECLINE soon. How could you use the interest rate swap above to hedge your uncertainty, meaning which direction would you enter pay or receive fixed? Furthermore, if the swap's duration is 4.1 years, would you use less/more than $100 million of the above 5 year swap?

Step by Step Solution

There are 3 Steps involved in it

The image contains a table detailing the cashflows for a standard interest rate swap along with your question in two parts a and b Here are your answe... View full answer

Get step-by-step solutions from verified subject matter experts