Question: You will recall, this is the Black-Scholes model, where Call = current call option value SO= current Stock price K = strike price N(d)

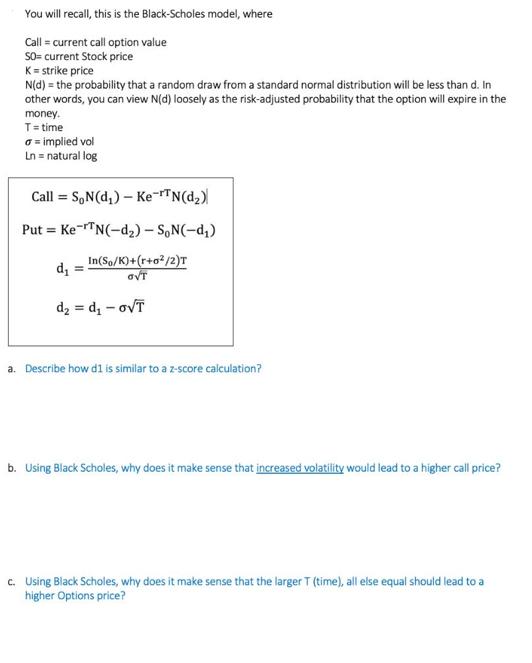

You will recall, this is the Black-Scholes model, where Call = current call option value SO= current Stock price K = strike price N(d) = the probability that a random draw from a standard normal distribution will be less than d. In other words, you can view N(d) loosely as the risk-adjusted probability that the option will expire in the money. T = time a=implied vol Ln = natural log Call SoN(d) - Ke-TN(d) = Put Ke N(-d)-SoN(-d) d = d = d - oT In(So/K)+(r+0/2)T GVT a. Describe how d1 is similar to a z-score calculation? b. Using Black Scholes, why does it make sense that increased volatility would lead to a higher call price? c. Using Black Scholes, why does it make sense that the larger T (time), all else equal should lead to a higher Options price?

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

a The calculation of d in the BlackScholes model is similar to a zscore calculation because it invol... View full answer

Get step-by-step solutions from verified subject matter experts