Question: 3. Ben Baker spends considerable time each year pursuing his electric train hobby; occasionally attending train shows throughout the eastern half of the United States.

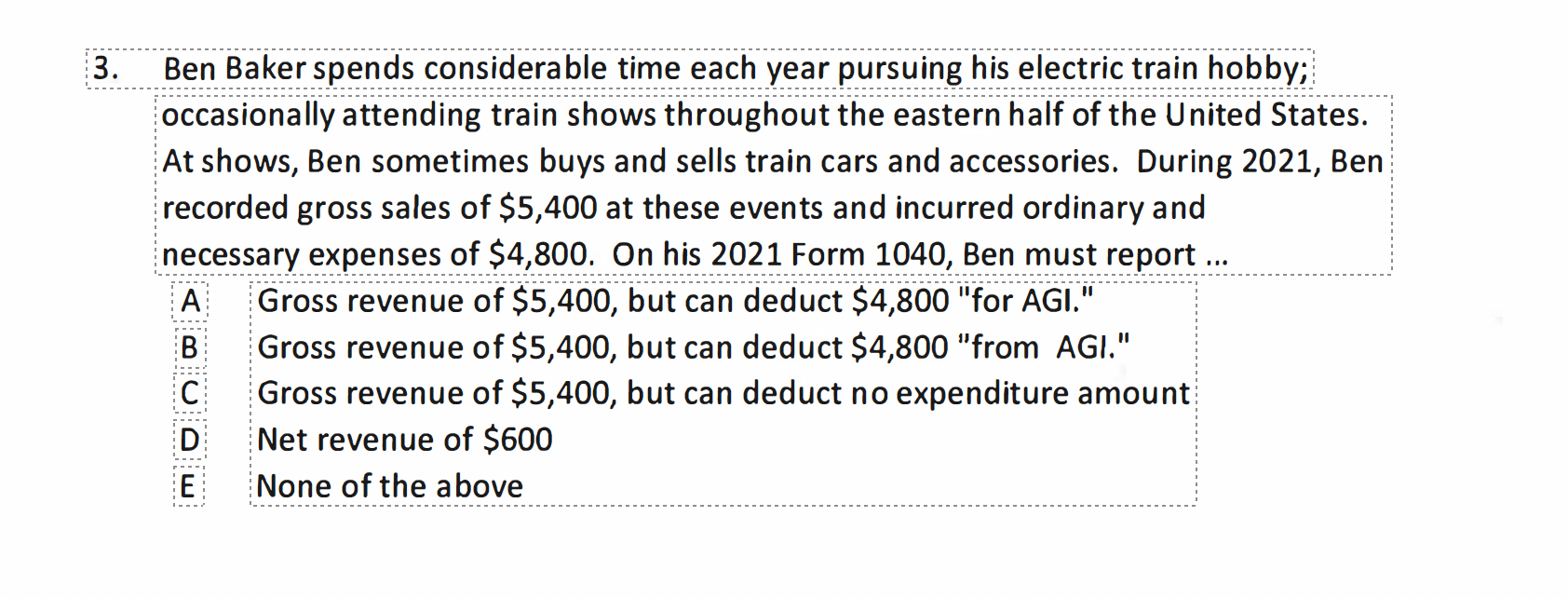

3. Ben Baker spends considerable time each year pursuing his electric train hobby; occasionally attending train shows throughout the eastern half of the United States. At shows, Ben sometimes buys and sells train cars and accessories. During 2021, Ben recorded gross sales of $5,400 at these events and incurred ordinary and necessary expenses of $4,800. On his 2021 Form 1040, Ben must report ... A Gross revenue of $5,400, but can deduct $4,800 "for AGl." B Gross revenue of $5,400, but can deduct $4,800 "from AGI." C. Gross revenue of $5,400, but can deduct no expenditure amount D. Net revenue of $600 E None of the above 3. Ben Baker spends considerable time each year pursuing his electric train hobby; occasionally attending train shows throughout the eastern half of the United States. At shows, Ben sometimes buys and sells train cars and accessories. During 2021, Ben recorded gross sales of $5,400 at these events and incurred ordinary and necessary expenses of $4,800. On his 2021 Form 1040, Ben must report ... A Gross revenue of $5,400, but can deduct $4,800 "for AGl." B Gross revenue of $5,400, but can deduct $4,800 "from AGI." C. Gross revenue of $5,400, but can deduct no expenditure amount D. Net revenue of $600 E None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts