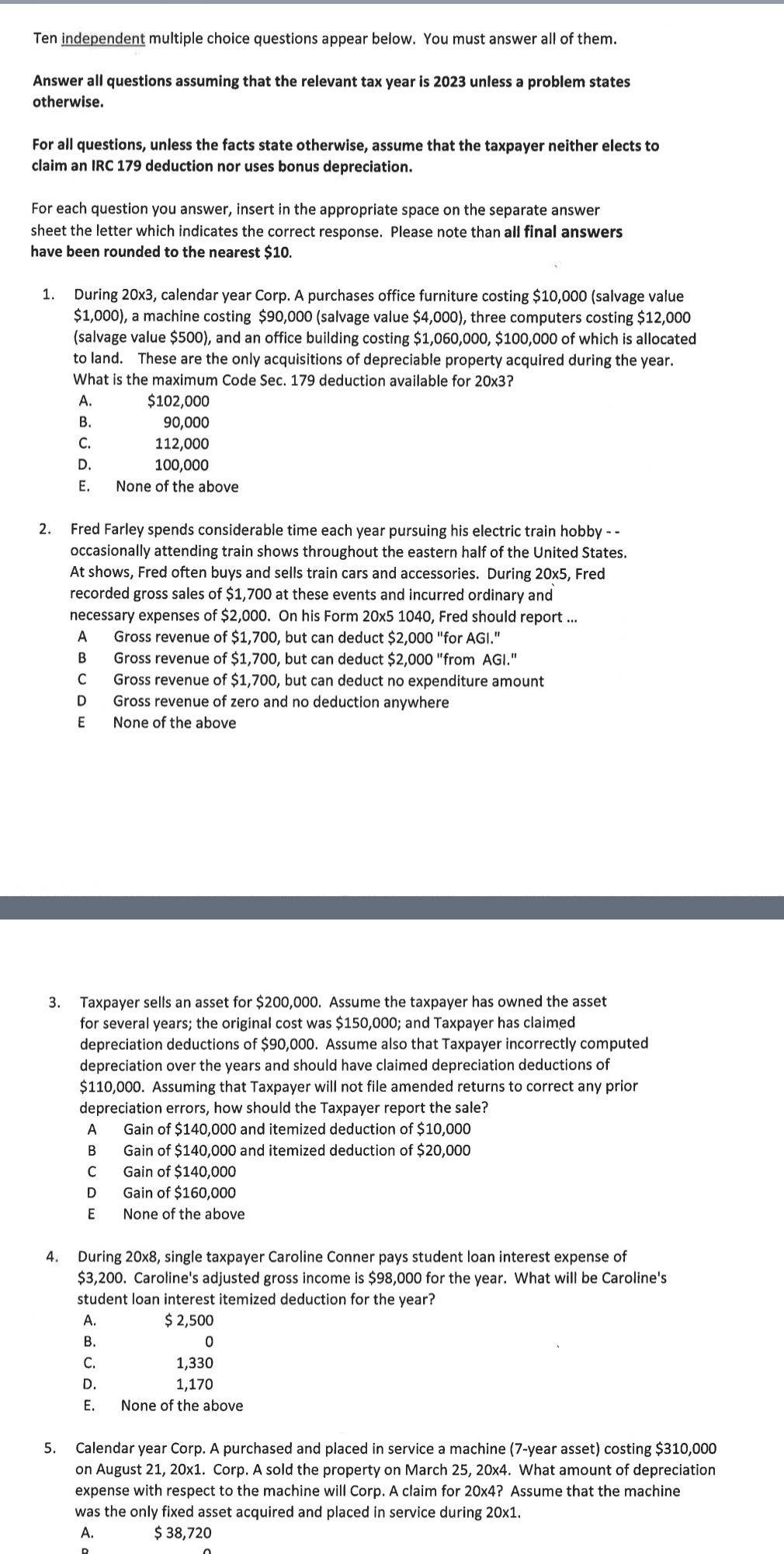

Question: 1 . During 2 0 x 3 , calendar year Corp. A purchases office furniture costing $ 1 0 , 0 0 0 ( s

During calendar year Corp. A purchases office furniture costing $ value $ a machine costing $ value $ three computers costing $ value $ and office building costing $ $ which allocated land.

These are the only acquisitions depreciable property acquired during the year.

What the maximum Code Sec. deduction available for

$

None the above

Fred Farley spends considerable time each year pursuing

Ten independent multiple choice questions appear below. You must answer all them.

Answer all questions assuming that the relevant tax year unless a problem states

otherwise.

For all questions, unless the facts state otherwise, assume that the taxpayer neither elects

claim IRC deduction nor uses bonus depreciation.

For each question you answer, insert the appropriate space the separate answer

sheet the letter which indicates the correct response. Please note than all final answers

have been rounded the nearest $

During calendar year Corp. A purchases office furniture costing $$ $$ $$ $$ which allocated

land. These are the only acquisitions depreciable property acquired during the year.

What the maximum Code Sec. deduction available for

$

None the above

Fred Farley spends considerable time each year pursuing his electric train hobby

occasionally attending train shows throughout the eastern half the United States.

shows, Fred often buys and sells train cars and accessories. During Fred

recorded gross sales $ these events and incurred ordinary and

necessary expenses $ his Form Fred should report

A Gross revenue $ but can deduct $ "for AGI."

Gross revenue $ but can deduct $ "from AGI."

Gross revenue $ but can deduct expenditure amount

Gross revenue zero and deduction anywhere

None the above

Taxpayer sells asset for $ Assume the taxpayer has owned the asset

for several years; the original cost was $; and Taxpayer has claimed

depreciation deductions $ Assume also that Taxpayer incorrectly computed

depreciation over the years and should have claimed depreciation deductions

$ Assuming that Taxpayer will not file amended returns correct any prior

depreciation errors, how should the Taxpayer report the sale?

A Gain $ and itemized deduction $

Gain $ and itemized deduction $

Gain $

Gain $

None the above

During single taxpayer Caroline Conner pays student loan interest expense

$ Caroline's adjusted gross income $ for the year. What will Caroline's

student loan interest itemized deduction for the year?

None the above

Calendar year Corp. A purchased and placed service a machine year asset costing $

August Corp. A sold the property March What amount depreciation

expense with respect the machine wil Calendar year Corp. A purchased and placed service a machine year asset costing $

August Corp. A sold the property March What amount depreciation

expense with respect the machine will Corp. A claim for Assume that the machine

was the only fixed asset acquired and placed service during

$

None the above

August Donald Dawson purchased and immediately placed service a small

apartment building for $ which $ was allocated the land which

the building was located. The estimated life the building was years, with a salvage

value $ What Donald's allowable depreciation for year

During calendar year Corp. A purchases and immediately places service assets

set out below.

May Office furniture $ useful life years, salvage value $

August Machine $ useful life years, salvage value $

November Machine $ useful life years, salvage value $

What depreciation deduction amount will Corp. A claim its federal income tax return

for the machine purchased A selfemployed attorney uses a country club for entertainment and client meetings. During

the attorney spends amounts set out below the club.

What amount will deductible against business income the attorney's federal

income tax return?

$

None the abovel Corp. A claim for Assume that the machine

was the only fixed asset acquired and placed service during

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock