Question: 3. Binomial tree: random interest rates II A stock that pays no dividends has current price 100. In one year's time the stock price

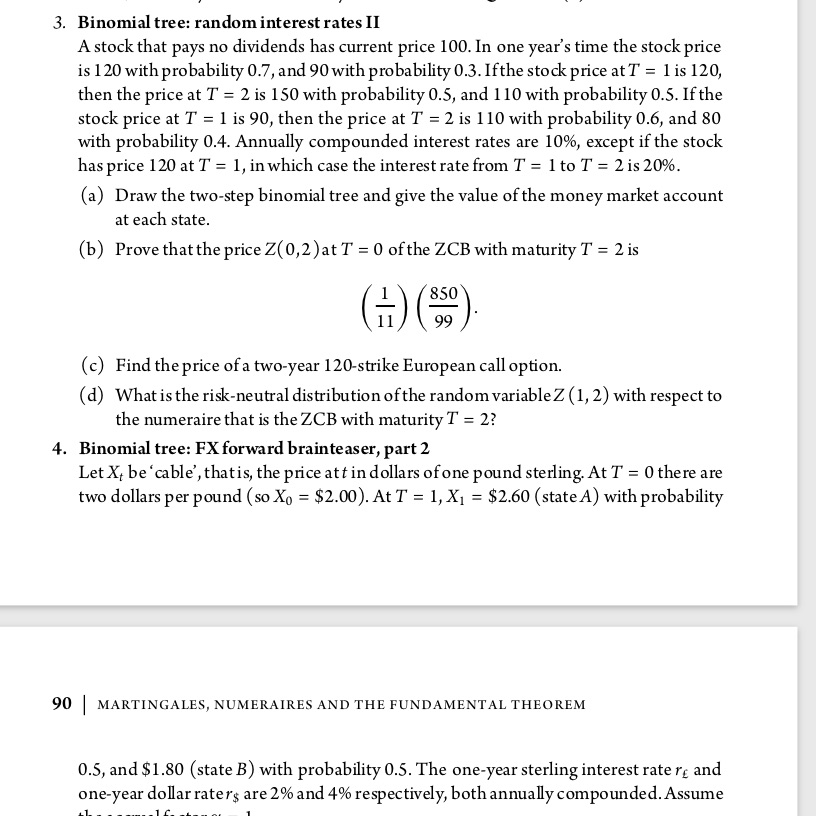

3. Binomial tree: random interest rates II A stock that pays no dividends has current price 100. In one year's time the stock price is 120 with probability 0.7, and 90 with probability 0.3. Ifthe stock price at T = 1 is 120, then the price at T = 2 is 150 with probability 0.5, and 110 with probability 0.5. If the stock price at T = 1 is 90, then the price at T = 2 is 110 with probability 0.6, and 80 with probability 0.4. Annually compounded interest rates are 10%, except if the stock has price 120 at T = 1, in which case the interest rate from T = 1 to T = 2 is 20%. (a) Draw the two-step binomial tree and give the value of the money market account at each state. (b) Prove that the price Z(0,2) at T = 0 of the ZCB with maturity T = 2 is 850 99 (c) Find the price of a two-year 120-strike European call option. (d) What is the risk-neutral distribution of the random variable Z (1, 2) with respect to the numeraire that is the ZCB with maturity T = 2? 4. Binomial tree: FX forward brainteaser, part 2 Let X be 'cable', that is, the price att in dollars of one pound sterling. At T = 0 there are two dollars per pound (so Xo = $2.00). At T = 1, X = $2.60 (state A) with probability 90 | MARTINGALES, NUMERAIRES AND THE FUNDAMENTAL THEOREM 0.5, and $1.80 (state B) with probability 0.5. The one-year sterling interest rate re and one-year dollar raters are 2% and 4% respectively, both annually compounded. Assume

Step by Step Solution

There are 3 Steps involved in it

question three Initial stock price S0100S0 100S0100 At T1T 1T1 S120S 120S120 with probability 07 S90S 90S90 with probability 03 If S120S 120S120 at T1T 1T1 At T2T 2T2 S150S 150S150 with 05 S110S 110S1... View full answer

Get step-by-step solutions from verified subject matter experts