Question: 3. Calculate the net present worth (NPW) using a nominal discount (interest) rate of 10%, with discrete year-end cash flows and discrete annual compounding. You

3. Calculate the net present worth (NPW) using a nominal discount (interest) rate of 10%, with discrete year-end cash flows and discrete annual compounding. You must account for the time value of money. You do NOT have to worry about inflation at all.

4. Calculate the discounted cash flow rate of return.

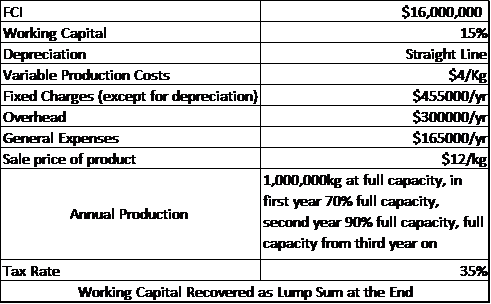

FCI $16,000,000 Working Capital 15% Depreciation Straight Line Variable Production Costs $A/Kg Fixed Charges (except for depreciation) $455000/y! Overhead $300000/y! General Expenses $165000/y Sale price of product $12/kg 1,000,000kg at full capacity, in first year 70% full capacity, Annual Production second year 90% full capacity, full capacity from third year on Tax Rate 35% Working Capital Recovered as Lump Sum at the End FCI $16,000,000 Working Capital 15% Depreciation Straight Line Variable Production Costs $A/Kg Fixed Charges (except for depreciation) $455000/y! Overhead $300000/y! General Expenses $165000/y Sale price of product $12/kg 1,000,000kg at full capacity, in first year 70% full capacity, Annual Production second year 90% full capacity, full capacity from third year on Tax Rate 35% Working Capital Recovered as Lump Sum at the End

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts