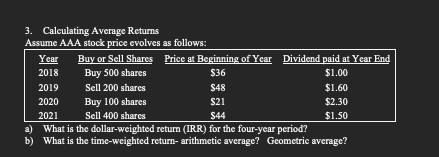

Question: 3. Calculating Average Returns Assume AAA stock price evolves as follows: begin{tabular}{|cccc|} hline Year & Buy or Sell Shares & Price at Beginning of Year

3. Calculating Average Returns Assume AAA stock price evolves as follows: \begin{tabular}{|cccc|} \hline Year & Buy or Sell Shares & Price at Beginning of Year & Dividend paid at Year End \\ 2018 & Buy 500 shares & $36 & $1.00 \\ 2019 & Sell 200 shares & $48 & $1.60 \\ 2020 & Buy 100 shares & $21 & $2.30 \\ 2021 & Sell 400 shares & $44 & $1.50 \\ \hline \end{tabular} a) What is the dollar-weighted return (IRR) for the four-year period? b) What is the time-weighted return- arithmetic average? Geometric average

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts