Question: Saved to this PC 1. Calculating Average Returns Assume AAA stock price evolves as follows: Year Buy or Sell Shares Price at Beginning of Year

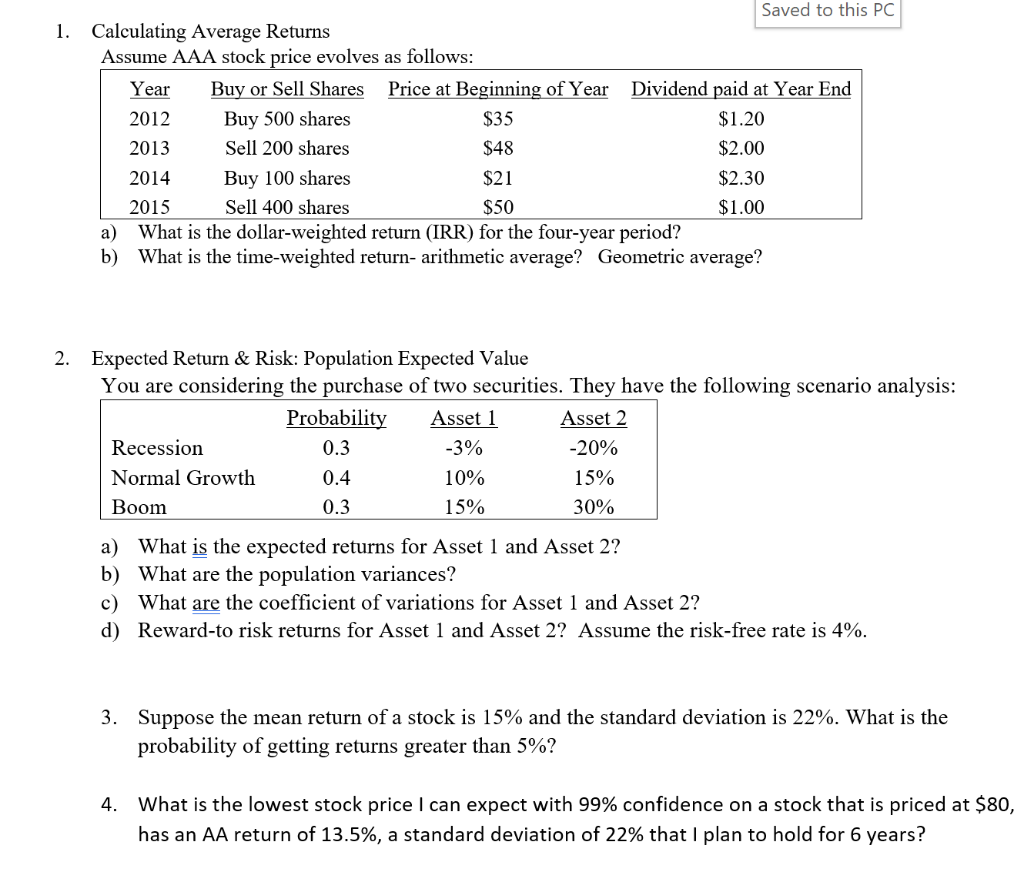

Saved to this PC 1. Calculating Average Returns Assume AAA stock price evolves as follows: Year Buy or Sell Shares Price at Beginning of Year Dividend paid at Year End 2012 Buy 500 shares $35 $1.20 2013 Sell 200 shares $48 $2.00 2014 Buy 100 shares $21 $2.30 2015 Sell 400 shares $50 $1.00 a) What is the dollar-weighted return (IRR) for the four-year period? b) What is the time-weighted return- arithmetic average? Geometric average? 2. Expected Return & Risk: Population Expected Value You are considering the purchase of two securities. They have the following scenario analysis: Probability Asset 1 Asset 2 Recession 0.3 -3% -20% Normal Growth 0.4 10% 15% Boom 0.3 15% 30% a) What is the expected returns for Asset 1 and Asset 2? b) What are the population variances? c) What are the coefficient of variations for Asset 1 and Asset 2? d) Reward-to risk returns for Asset 1 and Asset 2? Assume the risk-free rate is 4%. 3. Suppose the mean return of a stock is 15% and the standard deviation is 22%. What is the probability of getting returns greater than 5%? 4. What is the lowest stock price I can expect with 99% confidence on a stock that is priced at $80, has an AA return of 13.5%, a standard deviation of 22% that I plan to hold for 6 years? Saved to this PC 1. Calculating Average Returns Assume AAA stock price evolves as follows: Year Buy or Sell Shares Price at Beginning of Year Dividend paid at Year End 2012 Buy 500 shares $35 $1.20 2013 Sell 200 shares $48 $2.00 2014 Buy 100 shares $21 $2.30 2015 Sell 400 shares $50 $1.00 a) What is the dollar-weighted return (IRR) for the four-year period? b) What is the time-weighted return- arithmetic average? Geometric average? 2. Expected Return & Risk: Population Expected Value You are considering the purchase of two securities. They have the following scenario analysis: Probability Asset 1 Asset 2 Recession 0.3 -3% -20% Normal Growth 0.4 10% 15% Boom 0.3 15% 30% a) What is the expected returns for Asset 1 and Asset 2? b) What are the population variances? c) What are the coefficient of variations for Asset 1 and Asset 2? d) Reward-to risk returns for Asset 1 and Asset 2? Assume the risk-free rate is 4%. 3. Suppose the mean return of a stock is 15% and the standard deviation is 22%. What is the probability of getting returns greater than 5%? 4. What is the lowest stock price I can expect with 99% confidence on a stock that is priced at $80, has an AA return of 13.5%, a standard deviation of 22% that I plan to hold for 6 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts