Question: 3. Chapter 7-Home buying. Using the following hypothetical data and steps, figure out what the affordable home purchase price to be. a. Data: i. Annual

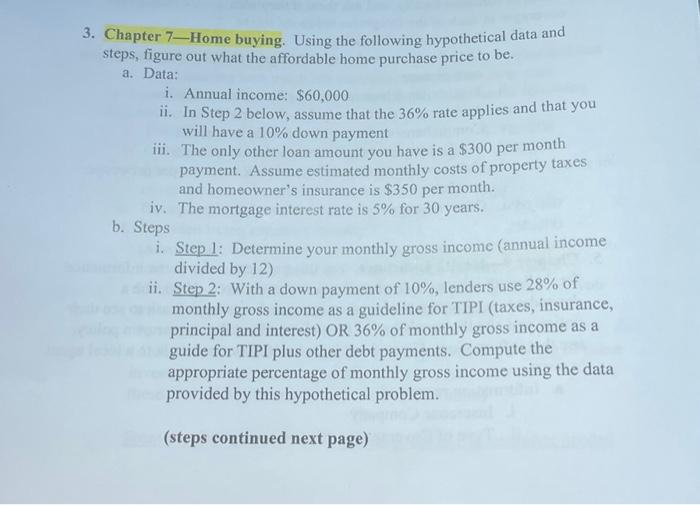

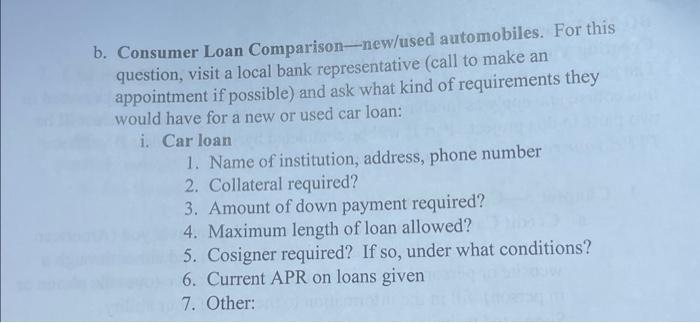

3. Chapter 7-Home buying. Using the following hypothetical data and steps, figure out what the affordable home purchase price to be. a. Data: i. Annual income: $60,000 ii. In Step 2 below, assume that the 36% rate applies and that you will have a 10% down payment iii. The only other loan amount you have is a $300 per month payment. Assume estimated monthly costs of property taxes and homeowner's insurance is $350 per month. iv. The mortgage interest rate is 5% for 30 years. b. Steps i. Step 1: Determine your monthly gross income (annual income divided by 12) ii. Step 2: With a down payment of 10%, lenders use 28% of monthly gross income as a guideline for TIPI (taxes, insurance, principal and interest) OR 36% of monthly gross income as a guide for TIPI plus other debt payments. Compute the appropriate percentage of monthly gross income using the data provided by this hypothetical problem. (steps continued next page) b. Consumer Loan Comparison-new/used automobiles. For this question, visit a local bank representative (call to make an appointment if possible) and ask what kind of requirements they would have for a new or used car loan: i. Car loan 1. Name of institution, address, phone number 2. Collateral required? 3. Amount of down payment required? 4. Maximum length of loan allowed? 5. Cosigner required? If so, under what conditions? 6. Current APR on loans given 7. Other: 3. Chapter 7-Home buying. Using the following hypothetical data and steps, figure out what the affordable home purchase price to be. a. Data: i. Annual income: $60,000 ii. In Step 2 below, assume that the 36% rate applies and that you will have a 10% down payment iii. The only other loan amount you have is a $300 per month payment. Assume estimated monthly costs of property taxes and homeowner's insurance is $350 per month. iv. The mortgage interest rate is 5% for 30 years. b. Steps i. Step 1: Determine your monthly gross income (annual income divided by 12) ii. Step 2: With a down payment of 10%, lenders use 28% of monthly gross income as a guideline for TIPI (taxes, insurance, principal and interest) OR 36% of monthly gross income as a guide for TIPI plus other debt payments. Compute the appropriate percentage of monthly gross income using the data provided by this hypothetical problem. (steps continued next page) b. Consumer Loan Comparison-new/used automobiles. For this question, visit a local bank representative (call to make an appointment if possible) and ask what kind of requirements they would have for a new or used car loan: i. Car loan 1. Name of institution, address, phone number 2. Collateral required? 3. Amount of down payment required? 4. Maximum length of loan allowed? 5. Cosigner required? If so, under what conditions? 6. Current APR on loans given 7. Other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts