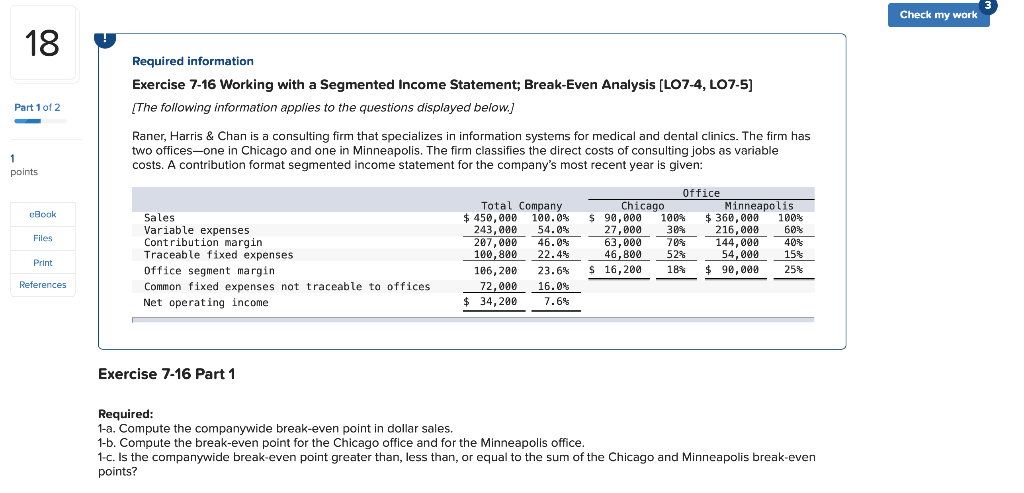

Question: 3 Check my work 18 Required information Exercise 7-16 Working with a Segmented Income Statement; Break-Even Analysis (LO7-4, LO7-5) [The following information applies to the

![to the questions displayed below.] Part 1 of 2 1 2 Raner,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e67b078707c_80766e67b07267f6.jpg)

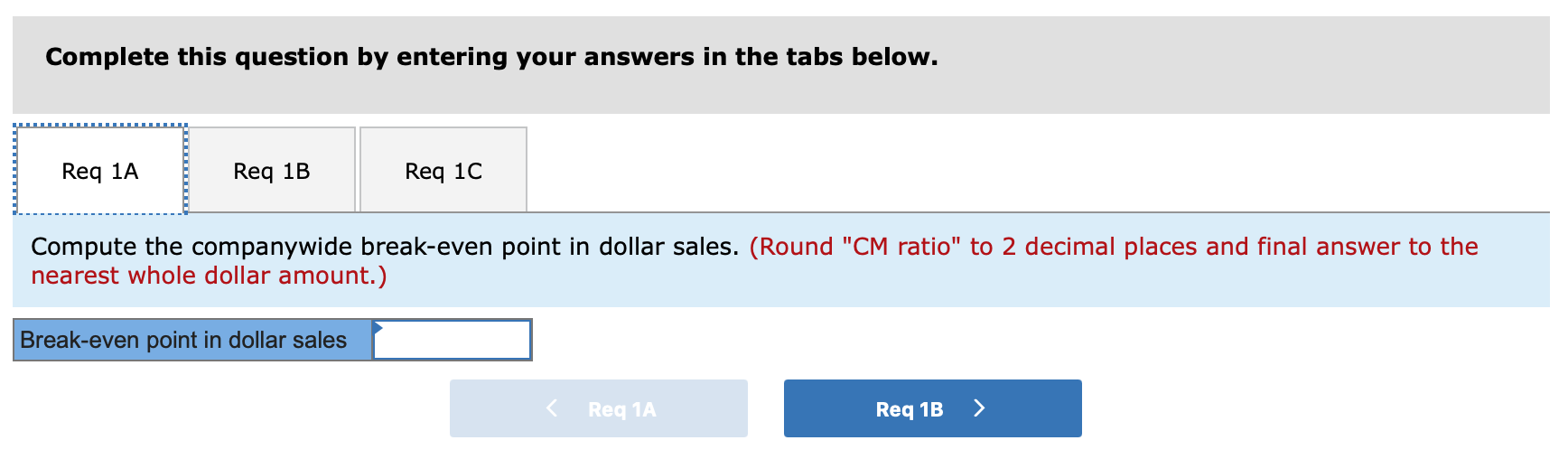

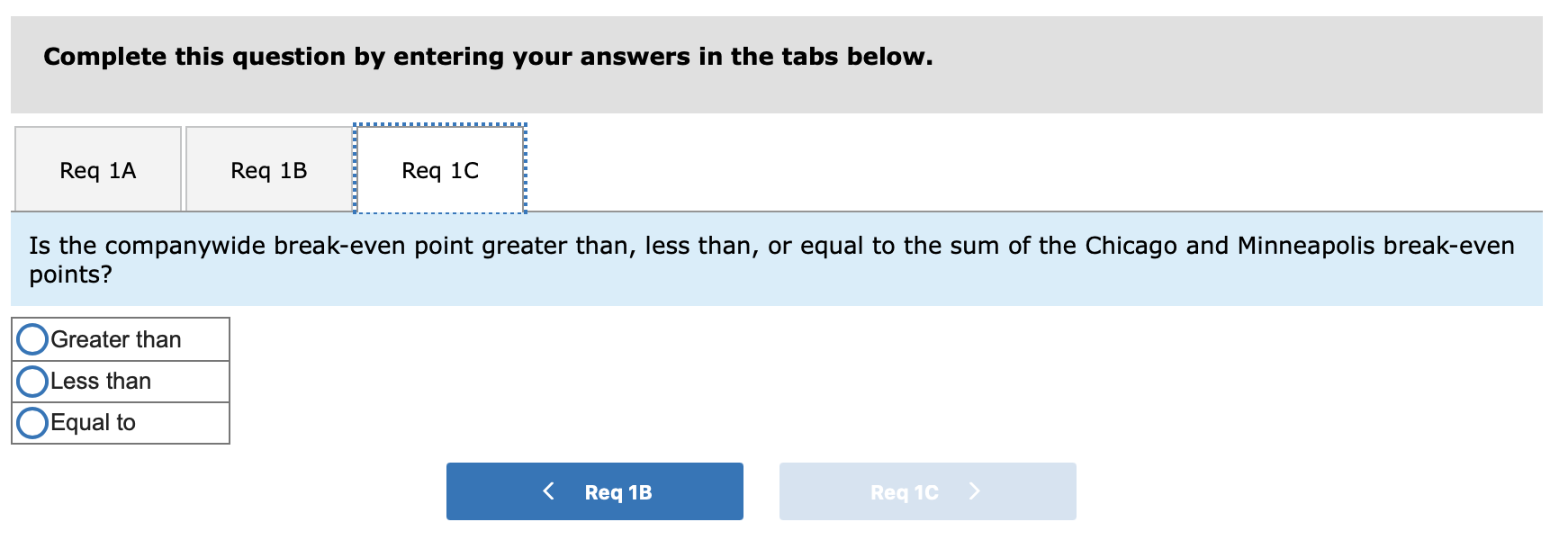

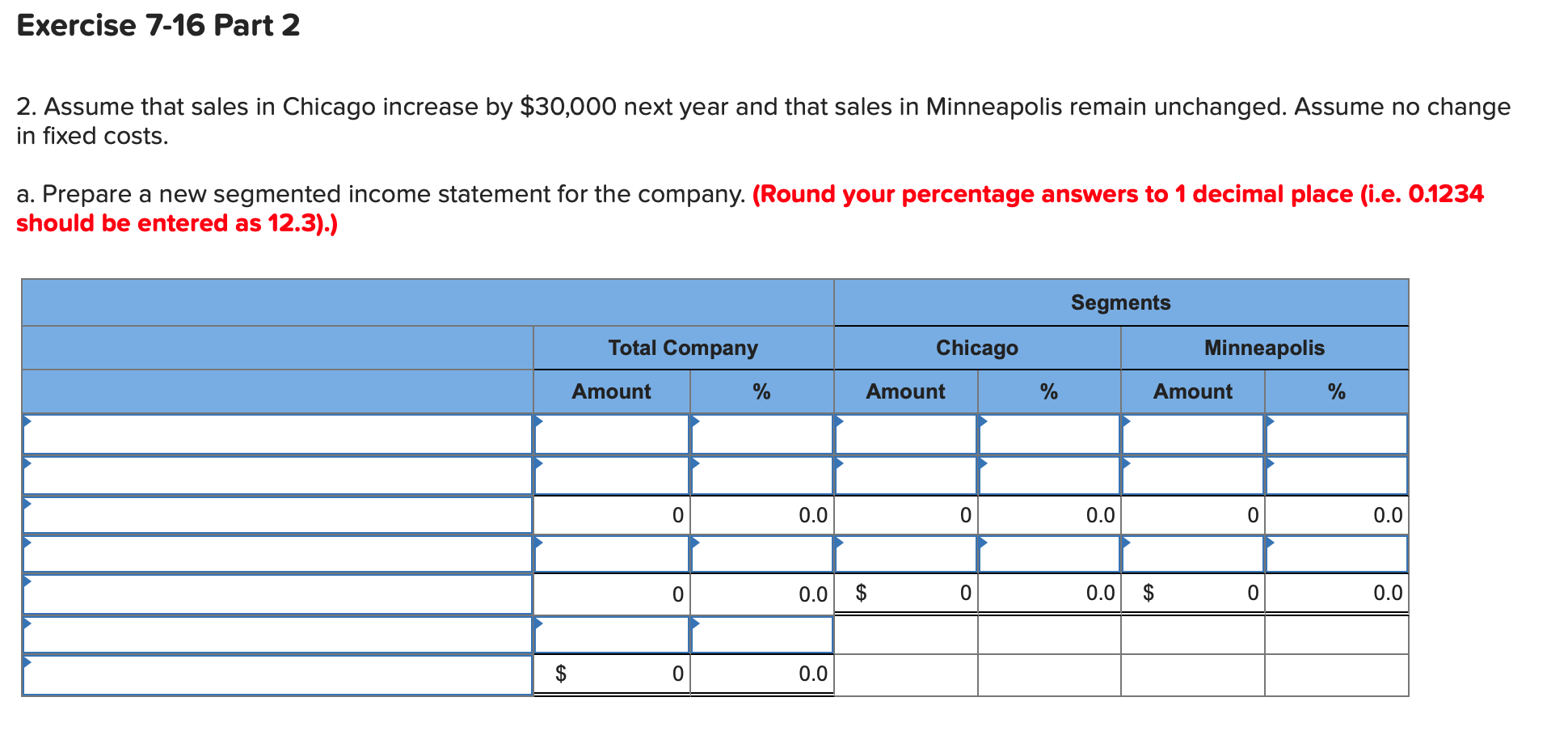

3 Check my work 18 Required information Exercise 7-16 Working with a Segmented Income Statement; Break-Even Analysis (LO7-4, LO7-5) [The following information applies to the questions displayed below.] Part 1 of 2 1 2 Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two officesone in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year given: 1 points eBook Files Total Company $ 450,000 100.0% 243,000 54.0% 207,000 46.4 100,800 22.44 186,200 23.6% 72,000 16.0% 34,200 7.6% Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Net operating income Office Chicago Minneapolis $ 90,000 100% $360,000 100% 27,000 30% 216,000 608 63,000 708 144,000 40% 46,800 52% 54,000 15% $ 16,200 18% $ 90,000 25% Print References Exercise 7-16 Part 1 Required: 1-a. Compute the companywide break-even point in dollar sales. 1-b. Compute the break-even point for the Chicago office and for the Minneapolis office. 1-c. Is the companywide break-even point greater than, less than or equal to the sum of the Chicago and Minneapolis break-even points? Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Compute the companywide break-even point in dollar sales. (Round "CM ratio" to 2 decimal places and final answer to the nearest whole dollar amount.) Break-even point in dollar sales Req 1A Req 1B > Exercise 7-16 Part 2 2. Assume that sales in Chicago increase by $30,000 next year and that sales in Minneapolis remain unchanged. Assume no change in fixed costs. a. Prepare a new segmented income statement for the company. (Round your percentage answers to 1 decimal place (i.e. 0.1234 should be entered as 12.3).) Segments Total Company Chicago Minneapolis Amount % Amount % Amount % 0 0.0 0 0.0 0 0.0 0 0.0 $ 0 0.0 $ 0 0.0 $ FA 0 0.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts