Question: Required information Exercise 7-16 Working with a Segmented Income Statement; Break-Even Analysis (LO7-4, LO7-5) (The following information applies to the questions displayed below.) Raner, Harris

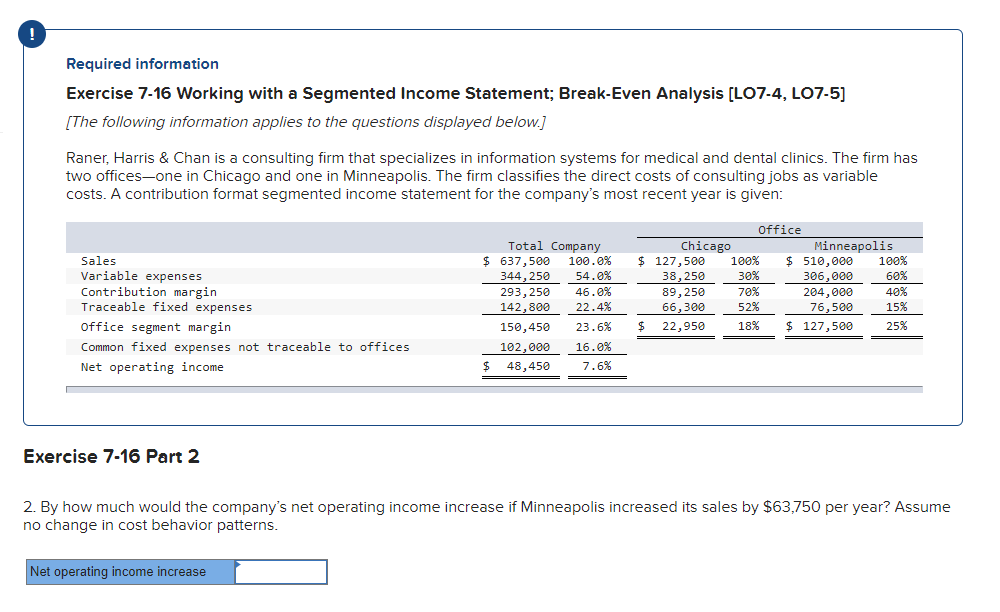

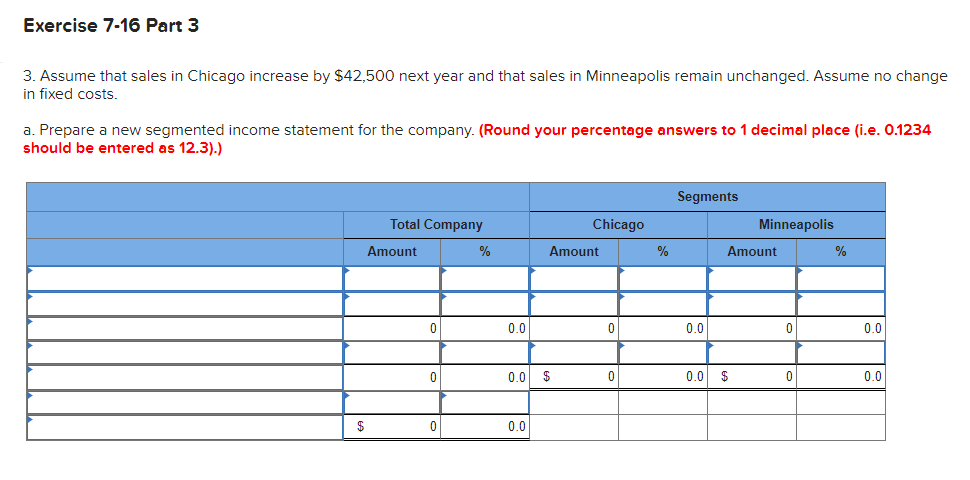

Required information Exercise 7-16 Working with a Segmented Income Statement; Break-Even Analysis (LO7-4, LO7-5) (The following information applies to the questions displayed below.) Raner, Harris & Chan is a consulting firm that specializes in information systems for medical and dental clinics. The firm has two offices-one in Chicago and one in Minneapolis. The firm classifies the direct costs of consulting jobs as variable costs. A contribution format segmented income statement for the company's most recent year is given: Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Net operating income Total Company $ 637,500 100.0% 344,250 54.0% 293, 250 46.0% 142,800 22.4% 150,450 23.6% 102,000 16.0% $ 48,450 7.6% Office Chicago Minneapolis $ 127,500 100% $ 510,000 100% 38,250 30% 306,000 60% 89,250 70% 204,000 40% 66,300 52% 76,500 15% $ 22,950 18% $ 127,500 25% Exercise 7-16 Part 2 2. By how much would the company's net operating income increase if Minneapolis increased its sales by $63,750 per year? Assume no change in cost behavior patterns. Net operating income increase Exercise 7-16 Part 3 3. Assume that sales in Chicago increase by $42,500 next year and that sales in Minneapolis remain unchanged. Assume no change in fixed costs. a. Prepare a new segmented income statement for the company. (Round your percentage answers to 1 decimal place (i.e. 0.1234 should be entered as 12.3).) Chicago Total Company Amount % Segments Minneapolis Amount % Amount % 0 0.0 0 0.0 0 0.0 0 0.0 $ 0 0.0 $ 0 0.0 $ 0 0.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts