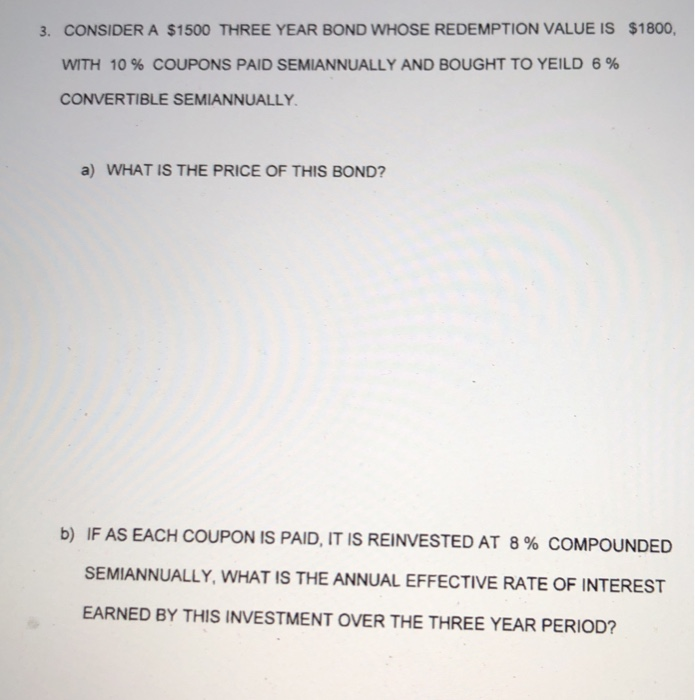

Question: 3. CONSIDER A $1500 THREE YEAR BOND WHOSE REDEMPTION VALUE IS $1800, WITH 10 % COUPONS PAID SEMIANNUALLY AND BOUGHT TO YEILD 6% CONVERTIBLE SEMIANNUALLY.

3. CONSIDER A $1500 THREE YEAR BOND WHOSE REDEMPTION VALUE IS $1800, WITH 10 % COUPONS PAID SEMIANNUALLY AND BOUGHT TO YEILD 6% CONVERTIBLE SEMIANNUALLY. a) WHAT IS THE PRICE OF THIS BOND? b) IF AS EACH COUPON IS PAID, IT IS REINVESTED AT 8% COMPOUNDED SEMIANNUALLY, WHAT IS THE ANNUAL EFFECTIVE RATE OF INTEREST EARNED BY THIS INVESTMENT OVER THE THREE YEAR PERIOD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts