Question: 3. Consider a project with a 3-year life. If it is terminated prior to Year 3, the machine will have a positive salvage value as

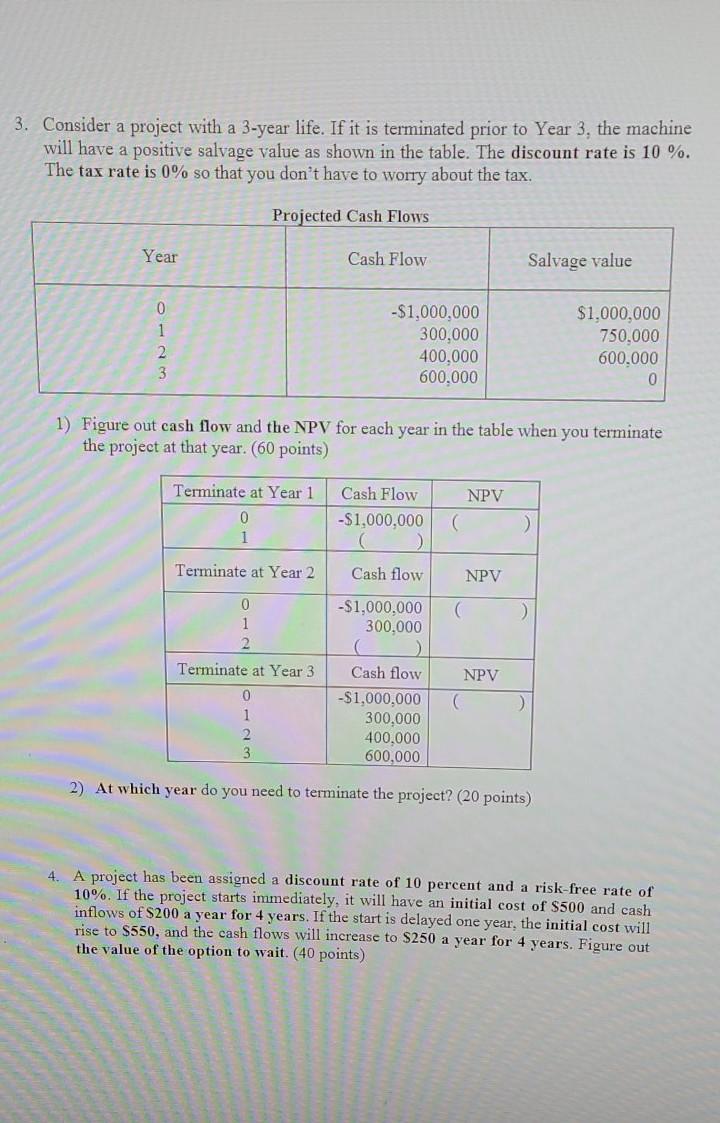

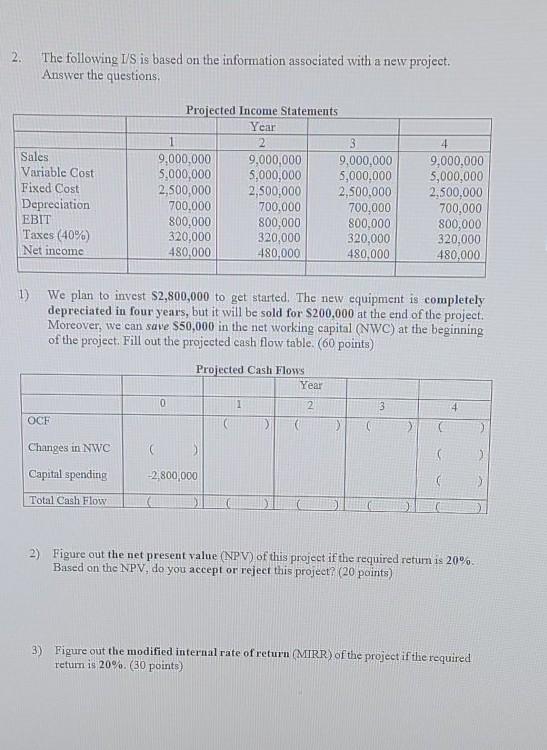

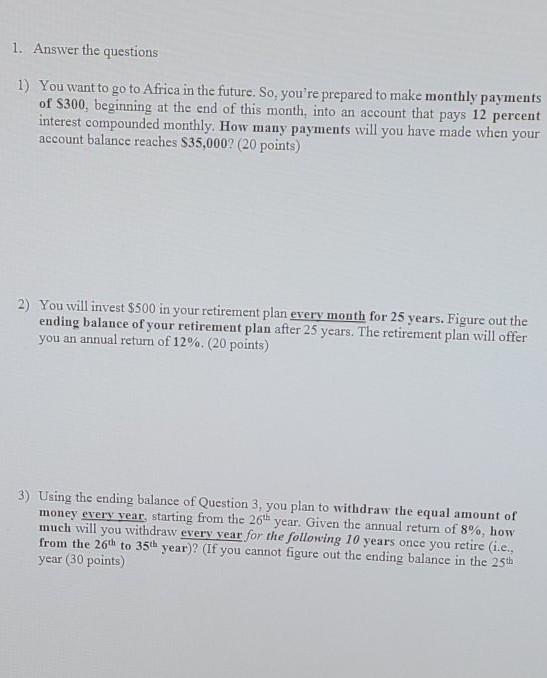

3. Consider a project with a 3-year life. If it is terminated prior to Year 3, the machine will have a positive salvage value as shown in the table. The discount rate is 10 %. The tax rate is 0% so that you don't have to worry about the tax. Projected Cash Flows Year Cash Flow Salvage value 0 1 2 3 -$1,000,000 300,000 400,000 600.000 $1,000,000 750,000 600.000 0 1) Figure out cash flow and the NPV for each year in the table when you terminate the project at that year. (60 points) NPV Terminate at Year 1 0 1 Cash Flow -$1,000,000 Terminate at Year 2 Cash flow NPV ( 0 1 2 Terminate at Year 3 NPV -$1,000,000 300,000 ( Cash flow -$1,000,000 300,000 400.000 600,000 ) 0 1 2. 3 2) At which year do you need to terminate the project? (20 points) 4. A project has been assigned a discount rate of 10 percent and a risk-free rate of 10%. If the project starts immediately, it will have an initial cost of $500 and cash inflows of $200 a year for 4 years. If the start is delayed one year, the initial cost will rise to $550, and the cash flows will increase to $250 a year for 4 years. Figure out the value of the option to wait. (40 points) 2. The following I/S is based on the information associated with a new project. Answer the questions Sales Variable Cost Fixed Cost Depreciation EBIT Taxes (40%) Net income Projected Income Statements Year 1 2 3 9,000,000 9,000,000 9,000,000 5,000,000 5,000,000 5,000,000 2,500,000 2,500,000 2,500,000 700.000 700.000 700.000 800,000 800,000 800,000 320,000 320,000 320,000 480,000 480,000 480,000 4 9,000,000 5,000,000 2,500,000 700.000 800,000 320,000 480,000 1) We plan to invest $2,800,000 to get started. The new equipment is completely depreciated in four years, but it will be sold for $200,000 at the end of the project. Moreover, we can save $50,000 in the net working capital (NWC) at the beginning of the project. Fill out the projected cash flow table. (60 points) Projected Cash Flows Year 1 2 0 3 4 OCE Changes in NWC Capital spending -2,800,000 Total Cash Flow 2) Figure out the net present value (NPV) of this project if the required return is 20% Based on the NPV, do you accept or reject this project? (20 points) 3) Figure out the modified internal rate of return (MIRR) of the project if the required return is 20% (30 points) 1. Answer the questions 1) You want to go to Africa in the future. So, you're prepared to make monthly payments of $300, beginning at the end of this month, into an account that pays 12 percent interest compounded monthly. How many payments will you have made when your account balance reaches S35,000? (20 points) 2) You will invest $500 in your retirement plan every month for 25 years. Figure out the ending balance of your retirement plan after 25 years. The retirement plan will offer you an annual return of 12%. (20 points) 3) Using the ending balance of Question 3, you plan to withdraw the equal amount of money every year, starting from the 26 year. Given the annual return of 8%, how much will you withdraw every year for the following 10 years once you retire (i.e., from the 26th to 35th year)? (If you cannot figure out the ending balance in the 25th year (30 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts