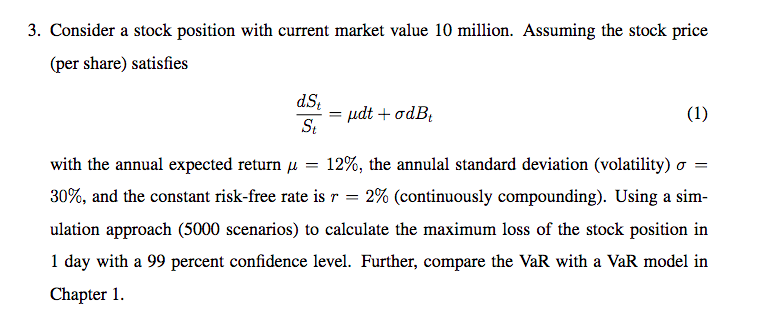

Question: 3. Consider a stock position with current market value 10 million. Assuming the stock price (per share) satisfies ds, SI udt+odB (1) with the annual

3. Consider a stock position with current market value 10 million. Assuming the stock price (per share) satisfies ds, SI udt+odB (1) with the annual expected return u 12%, the annulal standard deviation (volatility) 30%, and the constant risk-free rate is r = 2% (continuously compounding). Using a sim- ulation approach (5000 scenarios) to calculate the maximum loss of the stock position in 1 day with a 99 percent confidence level. Further, compare the VaR with a VaR model in Chapter 1. 3. Consider a stock position with current market value 10 million. Assuming the stock price (per share) satisfies ds, SI udt+odB (1) with the annual expected return u 12%, the annulal standard deviation (volatility) 30%, and the constant risk-free rate is r = 2% (continuously compounding). Using a sim- ulation approach (5000 scenarios) to calculate the maximum loss of the stock position in 1 day with a 99 percent confidence level. Further, compare the VaR with a VaR model in Chapter 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts