Question: Problem 6- Deviations FF 3-Factor Model Return The estimated parameters of the monthly Fama-French 3-Factor model are: R - Rfree = 0+0.7(Rm Suppose that the

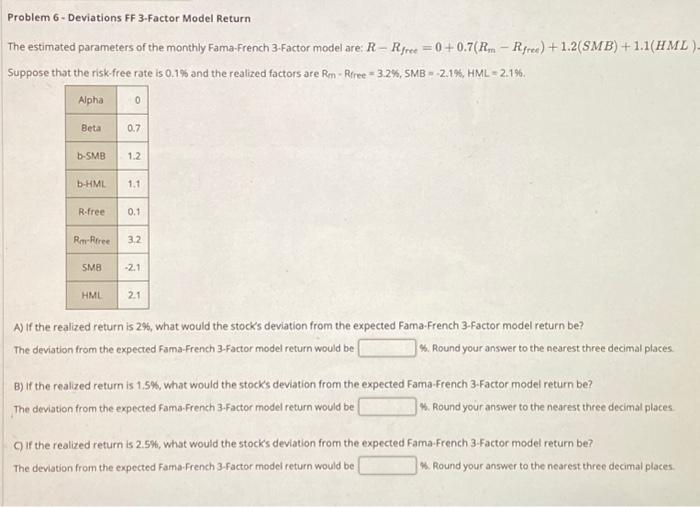

Problem 6-Deviations FF 3-Factor Model Return The estimated parameters of the monthly Fama-French 3-Factor model are: RRfree=0+0.7(RmRfret)+1.2(SMB)+1.1(HML). Suppose that the risk-free rate is 0.1% and the realized factors are RmRfree=3.2%,SMB=2.1%,HML=2.1%. A) if the realized return is 2%, what would the stocks deviation from the expected Fama-French 3-Factor model return be? The deviation from the expected fama-French 3.Factor model return would be 4. Round your answer to the nearest three decimal places. B) If the realized return is 1.5%, what would the stocks deviation from the expected Fama-French 3-Factor model return be? The deviation from the expected fama-French 3.Factor model return would be 4. Round your answer to the nearest three decimal places. Q) the realized return is 2.5%, what would the stocks deviation from the expected Fama-French 3-Factor model return be? The deviation from the expected fama-French 3 -Factor model return would be 2. Round your answer to the nearest three decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts