Question: 3. Consider a two-year maturity inverse floating-rate bond. Its coupon reset formula is 10%- LIBOR. Its discount rate is LIBOR+2%. Discount rate of fixed cash

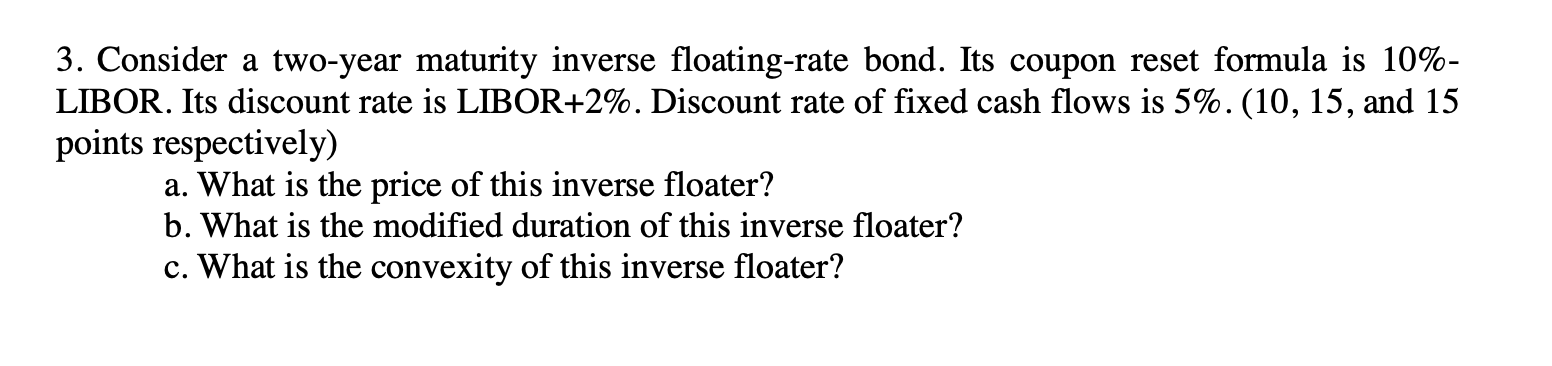

3. Consider a two-year maturity inverse floating-rate bond. Its coupon reset formula is 10%- LIBOR. Its discount rate is LIBOR+2%. Discount rate of fixed cash flows is 5%. (10, 15, and 15 points respectively) a. What is the price of this inverse floater? b. What is the modified duration of this inverse floater? c. What is the convexity of this inverse floater

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock