Question: 3. Consider an IPV setting with n bidders with types that are independently and identi- cally distributed over [0,100) according to the cdf F(x). i)

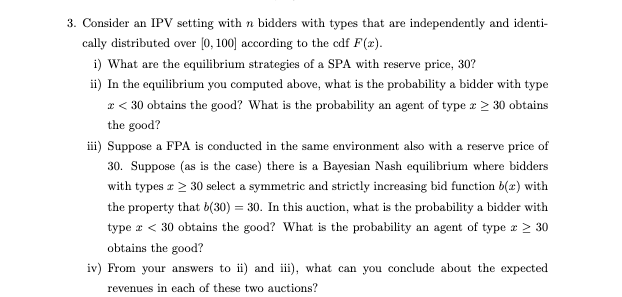

3. Consider an IPV setting with n bidders with types that are independently and identi- cally distributed over [0,100) according to the cdf F(x). i) What are the equilibrium strategies of a SPA with reserve price, 307 ii) In the equilibrium you computed above, what is the probability a bidder with type 30 obtains the good? iii) Suppose a FPA is conducted in the same environment also with a reserve price of 30. Suppose (as is the case) there is a Bayesian Nash equilibrium where bidders with types r > 30 select a symmetric and strictly increasing bid function b(x) with the property that b(30) = 30. In this auction, what is the probability a bidder with type x 30 obtains the good? iv) From your answers to ii) and iii), what can you conclude about the expected revenues in each of these two auctions? 3. Consider an IPV setting with n bidders with types that are independently and identi- cally distributed over [0,100) according to the cdf F(x). i) What are the equilibrium strategies of a SPA with reserve price, 307 ii) In the equilibrium you computed above, what is the probability a bidder with type 30 obtains the good? iii) Suppose a FPA is conducted in the same environment also with a reserve price of 30. Suppose (as is the case) there is a Bayesian Nash equilibrium where bidders with types r > 30 select a symmetric and strictly increasing bid function b(x) with the property that b(30) = 30. In this auction, what is the probability a bidder with type x 30 obtains the good? iv) From your answers to ii) and iii), what can you conclude about the expected revenues in each of these two auctions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts