Question: Consider Bed Bath and Beyond's pricing strategy for its blenders currently priced at $54. Suppose it pays $29 per blender from the manufacturer. Assume

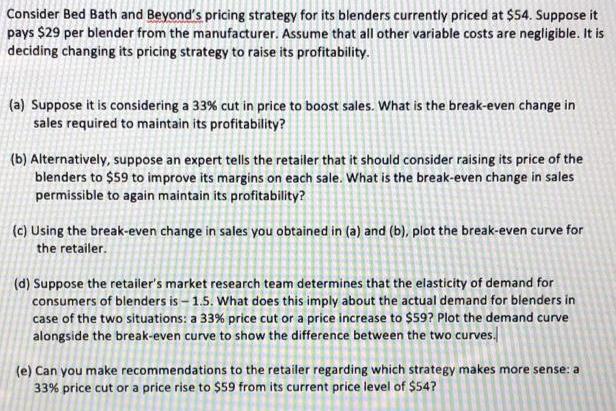

Consider Bed Bath and Beyond's pricing strategy for its blenders currently priced at $54. Suppose it pays $29 per blender from the manufacturer. Assume that all other variable costs are negligible. It is deciding changing its pricing strategy to raise its profitability. (a) Suppose it is considering a 33% cut in price to boost sales. What is the break-even change in sales required to maintain its profitability? (b) Alternatively, suppose an expert tells the retailer that it should consider raising its price of the blenders to $59 to improve its margins on each sale. What is the break-even change in sales permissible to again maintain its profitability? (c) Using the break-even change in sales you obtained in (a) and (b), plot the break-even curve for the retailer.. (d) Suppose the retailer's market research team determines that the elasticity of demand for consumers of blenders is-1.5. What does this imply about the actual demand for blenders in case of the two situations: a 33% price cut or a price increase to $59? Plot the demand curve alongside the break-even curve to show the difference between the two curves. (e) Can you make recommendations to the retailer regarding which strategy makes more sense: a 33% price cut or a price rise to $59 from its current price level of $54?

Step by Step Solution

3.37 Rating (169 Votes )

There are 3 Steps involved in it

Answer a In order for the retailer to maintain its profitability if it were t... View full answer

Get step-by-step solutions from verified subject matter experts