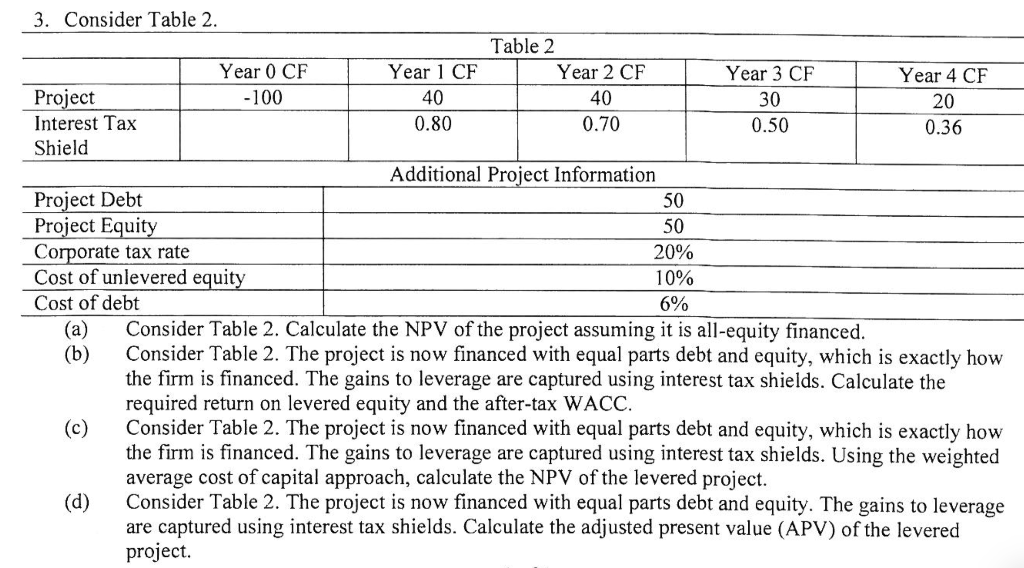

Question: 3. Consider Table 2 Table 2 Year 0 CF Year 2 CF Year 1 CF Year 3 CF Year 4 CF 100 40 Project 40

3. Consider Table 2 Table 2 Year 0 CF Year 2 CF Year 1 CF Year 3 CF Year 4 CF 100 40 Project 40 30 20 Interest Tax 0.70 0.80 0.50 0.36 Shield Additional Project Information Project Debt 50 Project Equity Corporate tax rate 50 20% 10% Cost of unlevered equit Cost of debt 6% (a) Consider Table 2. Calculate the NPV of the project assuming it is all-equity financed. (b) Consider Table 2. The project is now financed with equal parts debt and equity, which is exactly how the firm is financed. The gains to leverage are captured using interest tax shields. Calculate the required return on levered equity and the after-tax WACC. (c) Consider Table 2. The project is now financed with equal parts debt and equity, which is exactly how the firm is financed. The gains to leverage are captured using interest tax shields. Using the weighted average cost of capital approach, calculate the NPV of the levered project (d) Consider Table 2. The project is now financed with equal parts debt and equity. The gains to leverage are captured using interest tax shields. Calculate the adjusted present value (APV) of the levered project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts