Question: 3. Consider the following data on the U.S. dollar - British Pound exchange rate and the inter-bank lending rates of both nations (the London Inter

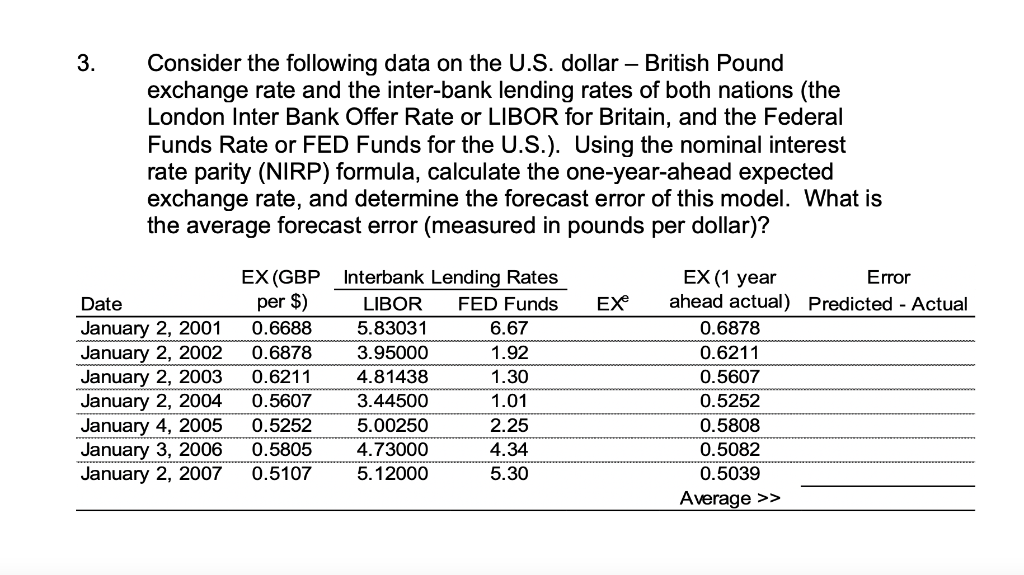

3. Consider the following data on the U.S. dollar - British Pound exchange rate and the inter-bank lending rates of both nations (the London Inter Bank Offer Rate or LIBOR for Britain, and the Federal Funds Rate or FED Funds for the U.S.). Using the nominal interest rate parity (NIRP) formula, calculate the one-year-ahead expected exchange rate, and determine the forecast error of this model. What is the average forecast error (measured in pounds per dollar)? EXE Date January 2, 2001 January 2, 2002 January 2, 2003 January 2, 2004 January 4, 2005 January 3, 2006 January 2, 2007 EX (GBP per $) 0.6688 0.6878 0.6211 0.5607 0.5252 0.5805 0.5107 Interbank Lending Rates LIBOR FED Funds 5.83031 6.67 3.95000 1.92 4.81438 1.30 3.44500 1.01 5.00250 2.25 4.73000 4.34 5.12000 5.30 EX (1 year Error ahead actual) Predicted - Actual 0.6878 0.6211 0.5607 0.5252 0.5808 0.5082 0.5039 Average >> 3. Consider the following data on the U.S. dollar - British Pound exchange rate and the inter-bank lending rates of both nations (the London Inter Bank Offer Rate or LIBOR for Britain, and the Federal Funds Rate or FED Funds for the U.S.). Using the nominal interest rate parity (NIRP) formula, calculate the one-year-ahead expected exchange rate, and determine the forecast error of this model. What is the average forecast error (measured in pounds per dollar)? EXE Date January 2, 2001 January 2, 2002 January 2, 2003 January 2, 2004 January 4, 2005 January 3, 2006 January 2, 2007 EX (GBP per $) 0.6688 0.6878 0.6211 0.5607 0.5252 0.5805 0.5107 Interbank Lending Rates LIBOR FED Funds 5.83031 6.67 3.95000 1.92 4.81438 1.30 3.44500 1.01 5.00250 2.25 4.73000 4.34 5.12000 5.30 EX (1 year Error ahead actual) Predicted - Actual 0.6878 0.6211 0.5607 0.5252 0.5808 0.5082 0.5039 Average >>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts