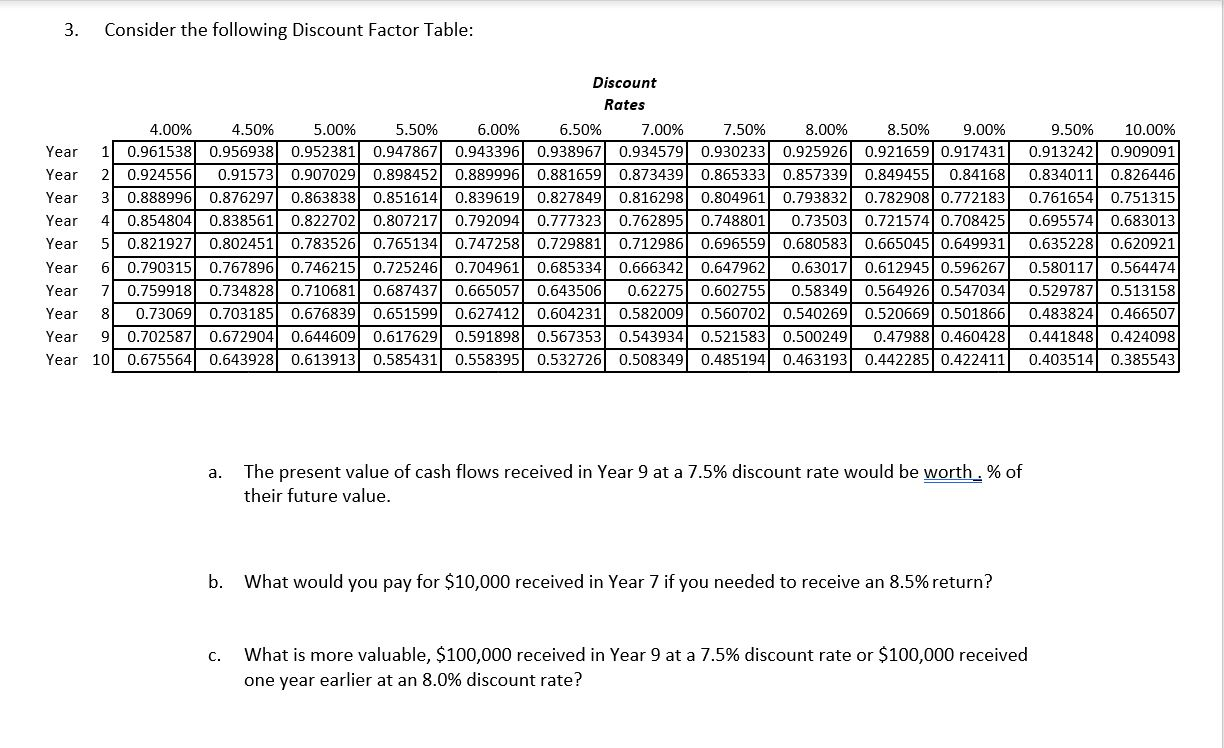

Question: 3. Consider the following Discount Factor Table: 2 Year Year Year Year Year Year Year Year Year Year Discount Rates 4.00% 4.50% 5.00% 5.50% 6.00%

3. Consider the following Discount Factor Table: 2 Year Year Year Year Year Year Year Year Year Year Discount Rates 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 8.00% 8.50% 9.00% 1 0.961538 0.956938 0.952381 0.947867 0.943396 0.938967 0.934579 0.930233 0.925926 0.921659 0.917431 0.924556 0.91573 0.907029 0.898452 0.889996 0.881659 0.873439 0.865333 0.857339 0.849455 0.84168 0.888996 0.876297 0.863838 0.851614 0.839619 0.827849 0.816298 0.804961 0.793832 0.782908 0.772183 4 0.8548041 0.838561 0.822702 0.807217 0.792094 0.777323 0.762895 0.748801 0.73503 0.721574 0.708425 5 0.821927 0.802451 0.783526 0.765134 0.747258 0.729881 0.712986 0.696559 0.680583 0.665045 0.649931 6 0.790315 0.767896 0.746215 0.725246 0.704961 0.685334 0.666342 0.647962 0.63017 0.612945 0.596267 0.759918 0.734828 0.710681 0.687437 0.665057 0.643506 0.62275 0.602755 0.58349 0.5649261 0.547034 8 0.73069 0.703185 0.676839 0.651599 0.627412 0.604231 0.582009 0.560702 0.540269 0.520669 0.501866 9 0.702587 0.672904 0.644609 0.617629 0.591898 0.567353 0.543934 0.521583 0.500249 0.47988 0.460428 10 0.675564 0.643928 0.613913 0.585431 0.558395 0.5327261 0.508349 0.485194 0.463193 0.442285 0.422411 9.50% 10.00% 0.913242 0.909091 0.834011 0.826446 0.761654 0.751315 0.695574 0.683013 0.635228 0.620921 0.580117 0.564474 0.529787 0.513158 0.483824 0.466507 0.441848 0.424098 0.403514 0.385543 a. The present value of cash flows received in Year 9 at a 7.5% discount rate would be worth,% of their future value. b. What would you pay for $10,000 received in Year 7 if you needed to receive an 8.5% return? C. What is more valuable, $100,000 received in Year 9 at a 7.5% discount rate or $100,000 received one year earlier at an 8.0% discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts