Question: 3. Consider the following table, which reports an evaluation by a financial analyst of the financial returns of a pair of stocks. Aggressive Stock (A)

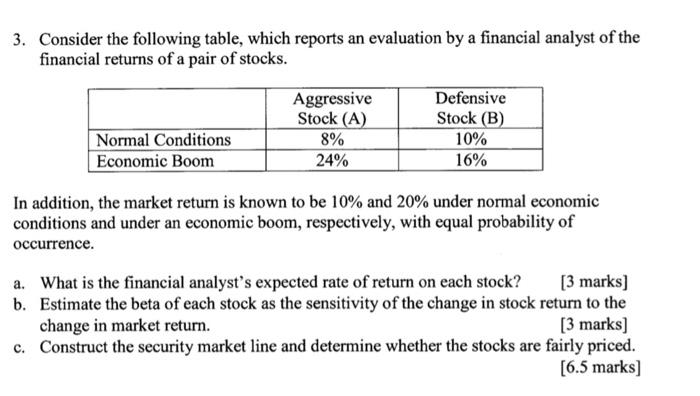

3. Consider the following table, which reports an evaluation by a financial analyst of the financial returns of a pair of stocks. Aggressive Stock (A) 8% 24% Defensive Stock (B) 10% 16% Normal Conditions Economic Boom In addition, the market return is known to be 10% and 20% under normal economic conditions and under an economic boom, respectively, with equal probability of occurrence. a. What is the financial analyst's expected rate of return on each stock? [3 marks) b. Estimate the beta of each stock as the sensitivity of the change in stock return to the change in market return. [3 marks) c. Construct the security market line and determine whether the stocks are fairly priced. [6.5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts