Question: 3) Consider the following yield curve (continuously compounded): Maturity (Years) Rate (annualized) .5 2.5 % .75 2.75 % 1.0 3.0 % 1.5 3.25 % 2.0

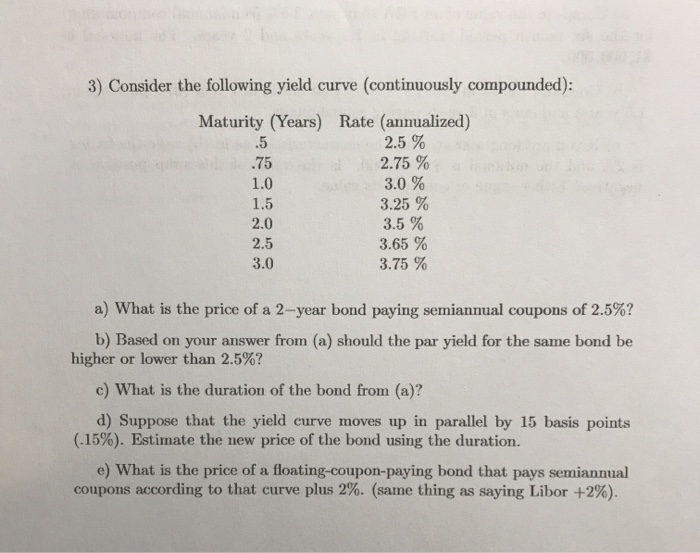

3) Consider the following yield curve (continuously compounded): Maturity (Years) Rate (annualized) .5 2.5 % .75 2.75 % 1.0 3.0 % 1.5 3.25 % 2.0 3.5 % 2.5 3.65 % 3.0 3.75 % a) What is the price of a 2-year bond paying semiannual coupons of 2.5%? b) Based on your answer from (a) should the par yield for the same bond be higher or lower than 2.5%? c) What is the duration of the bond from (a)? d) Suppose that the yield curve moves up in parallel by 15 basis points (.15%). Estimate the new price of the bond using the duration. e) What is the price of a floating-coupon-paying bond that pays semiannual coupons according to that curve plus 2%. (same thing as saying Libor +2%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts